U.S. Credit Card Debt Reaches Record $1.14 Trillion, Average Debt Now $6,501

U.S. consumers hit a record high of $1.142 trillion in credit card debt by Q2 2024. The average American now holds $6,501 in credit card debt in 2023, marking a 10% increase from 2022. Debt levels vary by state, with Alaska showing the highest average at $7,863, and Kansas the lowest at $5,227.

Credit card debt in the United States appears staggering at first glance. Consumers collectively owe a record $1.142 trillion on their credit cards, with the average American carrying a balance of $6,501. The Fool.com analyzed recent data from government agencies and credit bureaus to provide the latest insights into U.S. credit card debt.

As of the third quarter of 2023, the average American holds $6,501 in credit card debt, according to Experian. This marks a 10% increase from 2022 and is the first time since 2019 that average credit card debt has surpassed $6,000.

In the second quarter of 2024, U.S. credit card debt hit a record high, reaching $1.142 trillion. Although credit card debt varied during the pandemic, it began to increase steadily starting in 2021 as inflation surged.

Over the past ten years, credit card debt has generally made up between 5.5% and 6.5% of total household debt.

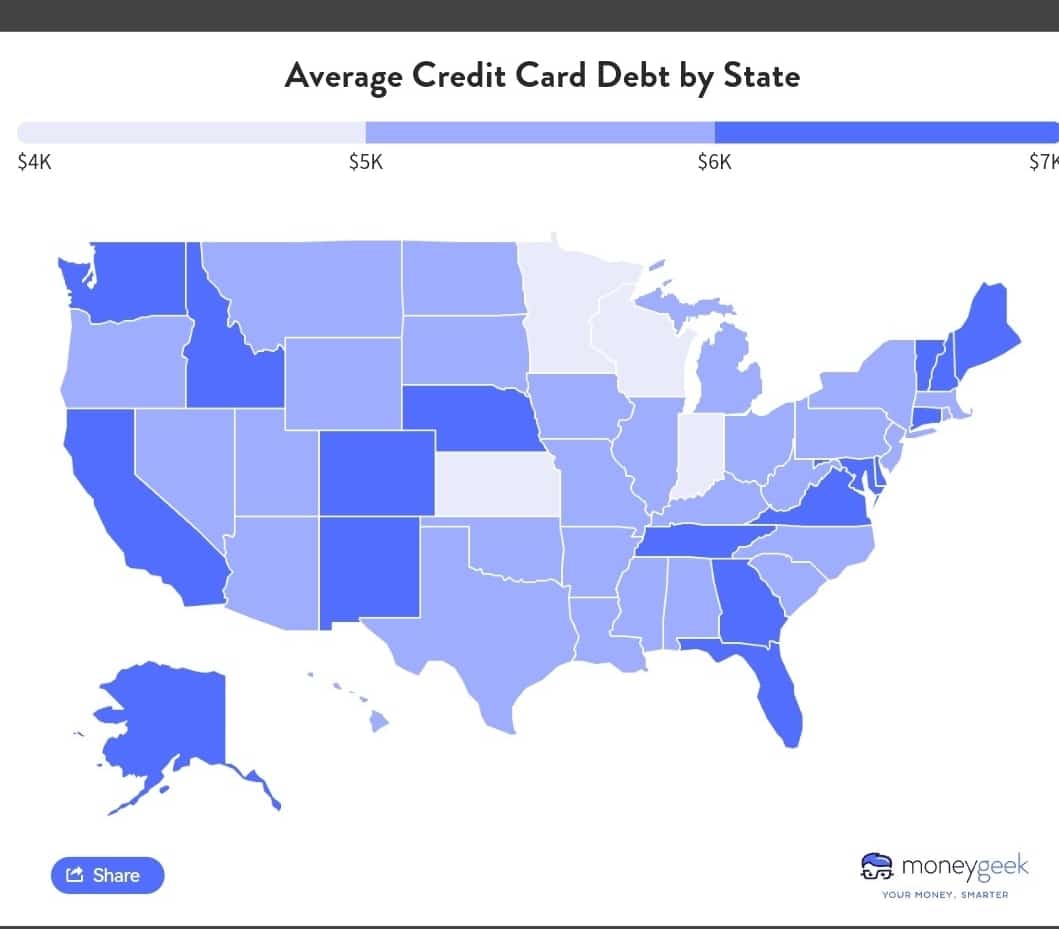

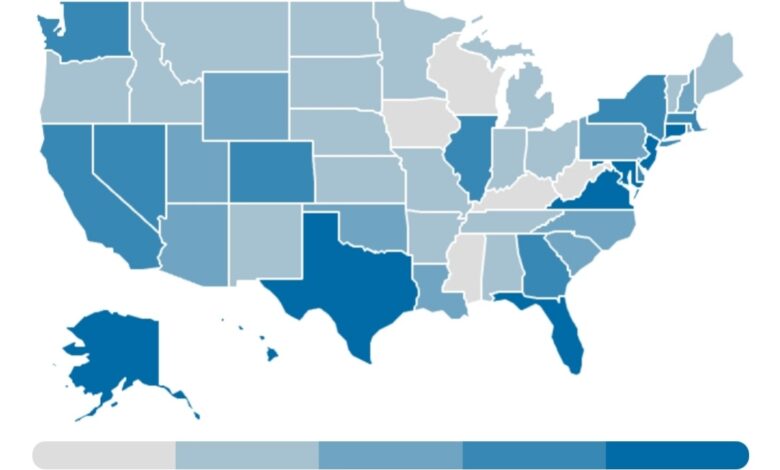

Average credit card debt by state

Alaska holds the highest average credit card debt in the country, with an amount of $7,863. In contrast, Kansas and Wisconsin have the lowest average balances at $5,227 and $5,242, respectively. Credit card debt varies significantly across different states, and this data reflects the average balances for each state as of 2023.

The average American household carries approximately $8,689 in credit card debt, according to the latest data on U.S. credit card debt and households. This figure was derived by dividing the total U.S. credit card debt of $1.142 trillion in the second quarter of 2024 by the number of households recorded in 2023, which was 131.434 million.