13.4% of U.S. Homeowners Are Not Covered by Homeowners Insurance

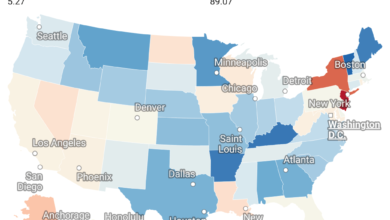

A recent analysis by Professpost.com of new Census Bureau data reveals that 13.4% of homeowners, or roughly 1 in 8, lack homeowners insurance across the country.

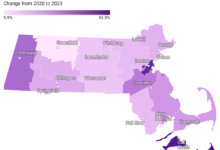

Experts warn that the significant rise in households lacking adequate insurance over the past five years is concerning, as it hinders recovery efforts following natural disasters.

In Louisiana’s Terrebonne Parish, where 94% of homes lost power after Hurricane Francine made landfall on Thursday, the absence of insurance could prove disastrous for many homeowners. Approximately one in four of the 31,000 homeowners in the coastal area are uninsured, making it one of the highest uninsured rates in the U.S.

In the South, the proportion of homeowners without insurance is the highest, with 15.7% either lacking coverage entirely or paying so little that experts consider their policies inadequate. This creates a challenging situation in a region where households are less financially prepared to cope with severe climate events, yet face a higher likelihood of experiencing them.

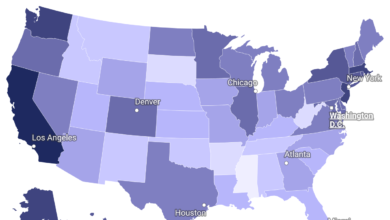

Under-insurance is more prevalent in counties with majority-minority populations. In counties predominantly Native American and Native Alaskan, 22% of homeowners are uninsured, while 14% of homeowners in majority-Black counties lack insurance.

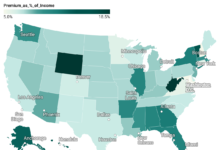

The census data reveals the percentage of homeowners who pay less than $100 for homeowners insurance, or none at all. Martin explained that this range includes households that either do not have insurance or are so underinsured that the situation is effectively the same.

According to a survey conducted by the Census Bureau last year, 20.8% of homeowners without mortgages also lack adequate homeowners insurance. Among those with mortgages, 8.5% do not have sufficient coverage. While banks typically require homeowners with mortgages to maintain insurance, coverage gaps still occur.