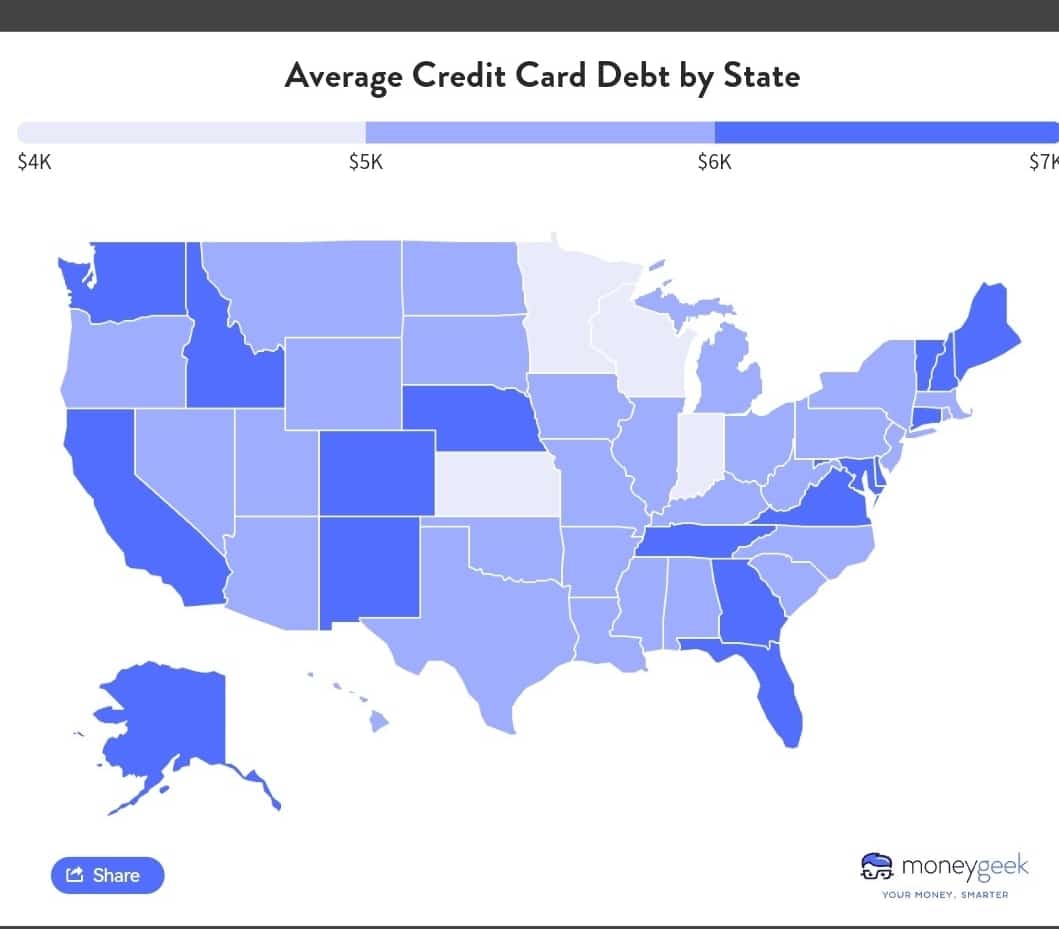

Average Credit Card Debt by U.S. States

Credit card debt in the U.S. rose during the initial half of 2023, accompanied by the opening of 28.5 million additional credit card accounts by Americans.

MoneyGeek conducted an analysis of credit card debt statistics, examining variations in the average amount of debt per person based on factors such as age, race, income, and location. This study aims to provide insights into the state of debt in the U.S. and the factors influencing credit card debt.

In the second quarter of 2023, the United States experienced a notable uptick in credit card accounts, witnessing a 5.2% surge to reach a staggering 578.35 million—reflecting an increase of 28.5 million since the same period in 2022. This growth in credit card accounts coincided with a substantial rise in overall credit card debt, which reached a 20-year peak at $1.031 trillion, compared to $887 billion recorded in the second quarter of the previous year.

Examining individual cardholder statistics, the average credit card debt per person saw a discernible climb from $5,963 in Q2 2022 to $6,568 in Q2 2023. Further analysis of demographic segments revealed that individuals aged 75 or older bore the heaviest debt burden, with an average of $8,100, whereas those under 35 carried the least, with an average debt of $3,700.

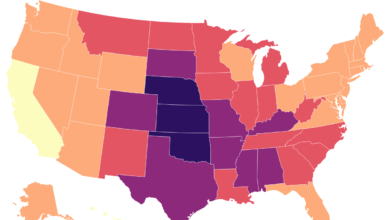

Geographically, Alaska emerged as the state with the highest average credit card debt, standing at $7,338, while Wisconsin recorded the lowest average at $4,808.

Delving into income brackets, individuals falling within the 60th to 79.9th annual income percentile exhibited a higher likelihood of carrying credit card debt, with approximately 57% of individuals in this bracket reporting such financial obligations.

In terms of racial demographics, White Americans reported the highest average debt per person, reaching $6,900, while individuals identifying as Black or African American had the lowest average debt at $3,900. These nuanced insights provide a comprehensive overview of the evolving landscape of credit card usage and debt in the United States during the specified period.

Source ; Federal Reserve Bank of New York and Survey of Consumer Finance