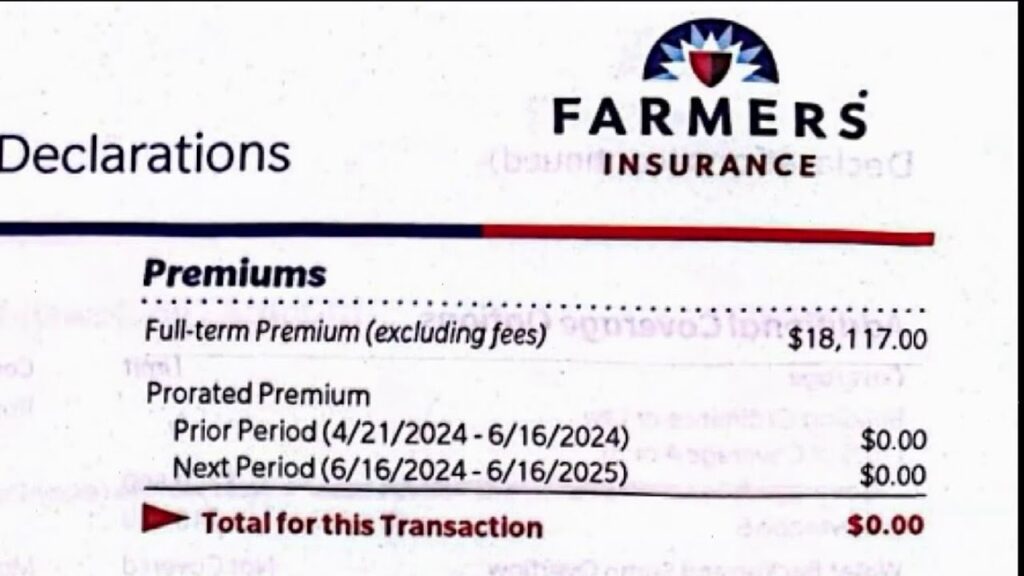

In a recent development, a South Bay family witnessed the insurance premium for one of their properties double, despite the property not being located in a high-fire risk area. This substantial increase reflects a broader trend of insurance companies canceling policies and raising rates nationwide, largely citing concerns about fire risks.

Pamela Tremain, the homeowner, expressed her surprise, stating, “I was dumbfounded because our annual premium absolutely doubled.” The premium for their second home in Amador County surged from $9,000 to $18,000 per year.

Seeking clarification, Tremain contacted Farmers Insurance and was informed that the escalated premium is attributed to California’s inflation.

Robert Chapman Wood, an economics professor at San Jose State University, pointed out that the instability in the insurance market is causing significant hikes in premiums. “Currently, insurance companies are acting out of panic, seizing opportunities wherever they can find them,” Wood remarked.

He emphasized that all Californians are affected by the state’s devastating wildfires, irrespective of whether they reside in high-risk areas.

Additionally, with an increasing number of companies discontinuing policies, families feel compelled to pay, leaving them with limited alternatives. Wood likened the current state of the insurance market to the volatility seen in the oil and gas industry, where prices fluctuate dramatically based on supply and demand.