The 8 U.S. States with the Highest Property Tax Burden for Homeowners

The Tax Foundation’s analysis shows that annual property tax payments in the United States can differ by thousands of dollars based on one’s location.

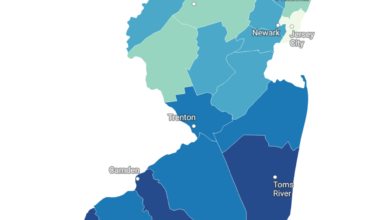

In New Jersey, the median property tax payment stands at $8,797, making it the highest among all U.S. states. Conversely, in Alabama, residents pay significantly less, with a median property tax bill of only $646. These figures were determined using data from a five-year span of Census information up to 2021, the most recent data available. When considering all states and the District of Columbia, the median property tax bill across the nation averages $2,331.

| 8 Most Expensive | Price |

|---|---|

| New Jersey | $8,797.00 |

| Connecticut | $6,153.00 |

| New Hampshire | $6,036.00 |

| New York | $5,884.00 |

| Massachusetts | $5,091.00 |

| Illinois | $4,744.00 |

| Vermont | $4,570.00 |

| Rhode Island | $4,483.00 |

Differences in property tax burdens between states are mainly attributed to variations in home prices and property tax rates. For instance, in 2021, the average effective property tax rate ranged from a low of 0.32% in Hawaii to a high of 2.23% in New Jersey, according to the Tax Foundation’s analysis of Census data.

New Jersey faces a unique challenge as it not only has the highest effective property tax rate in the U.S. but also some of the highest home costs in the country. This results in homeowners in New Jersey paying substantial amounts in property taxes.

Hawaii boasts the lowest property tax rate among all states, but its high home prices place it closer to the middle in terms of the actual property tax costs incurred by homeowners.

The study reveals that property taxes account for 32.2% of state and local revenues in the U.S., with these revenues typically being allocated to support vital services such as schools, roads, police departments, fire departments, and emergency medical services.

In states that prioritize local governance at the county and municipal levels, property tax bills tend to be higher. This includes states like New Jersey, New York, and Illinois.

Even in states with a reputation for low taxes, such as Texas and New Hampshire, property taxes can be surprisingly high. These states forego personal income taxes and rely more on property tax revenue to finance government services.

Property taxes can exhibit significant variation even within a single state, with residents in urban areas generally facing higher tax burdens due to elevated property values and increased infrastructure expenses. The Tax Foundation determined median property tax figures by considering the median tax payments made by owners of occupied homes from 2017 to 2021, utilizing data derived from the U.S. Census American Community Survey. It’s important to note that this data specifically pertains to property taxes paid by homeowners and excludes taxes paid by businesses and renters.