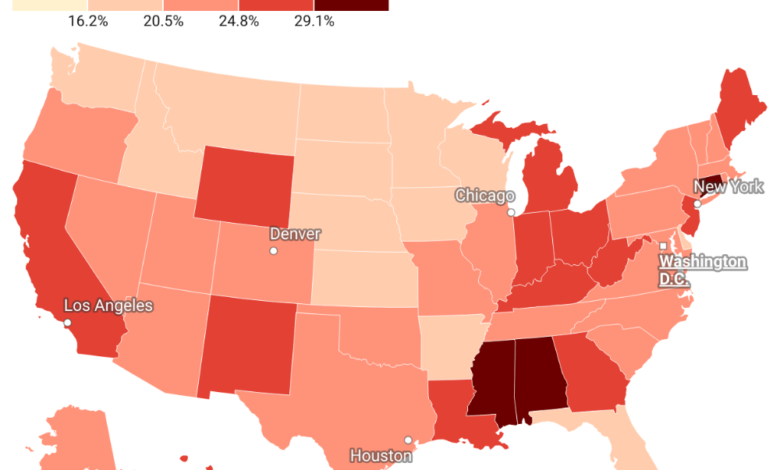

Financial Strain: Over 23% of Americans Struggling to Pay Energy Bills

Millions of Americans are struggling to afford their energy bills, with the crisis worsening in recent years. A significant portion of Americans, over one-third (34.3%), have resorted to drastic measures to cover energy costs.

In the past year, they have had to cut back on or forgo essential expenses, such as food or medicine. Additionally, nearly a quarter (23.4%) were unable to pay their full energy bill. These figures represent a slight increase from the previous year, highlighting the growing financial burden of energy costs for many households.

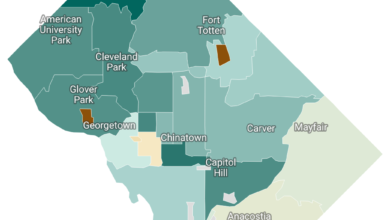

Mississippi leads the nation in energy affordability struggles, with a staggering 33.4% of residents reporting being unable to pay part or all of their bills at least once over the past 12 months. Other states facing significant challenges include Connecticut, Alabama, Louisiana, Maine, and Alaska, where over 25% of residents struggle to pay their energy bills.

Several factors contribute to this crisis, including rising energy prices, economic disparities, and outdated housing stock. Low-income households are particularly vulnerable, as they often spend a significant portion of their income on energy costs.

To address this pressing issue, policymakers and energy providers must implement a multifaceted approach. This includes investing in energy efficiency programs to reduce energy consumption and lower bills, providing targeted assistance to low-income households, promoting renewable energy sources, and implementing policy reforms to strengthen consumer protections and promote competition in the energy market.