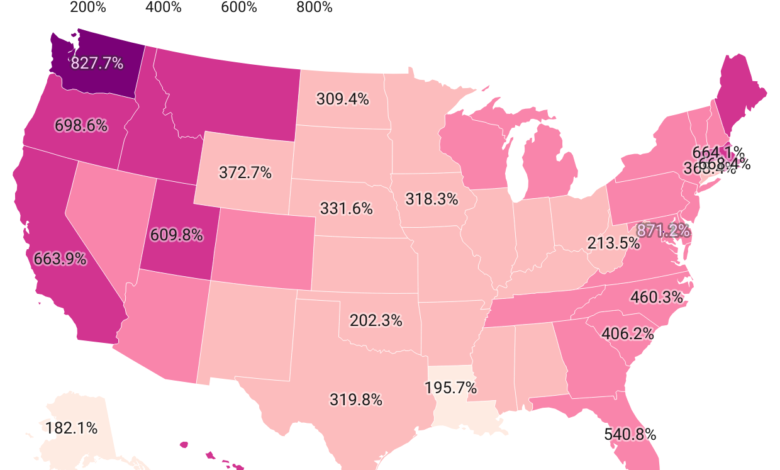

U.S. State-by-State House Price Changes Since 1984: Trends and Annual Growth Rates

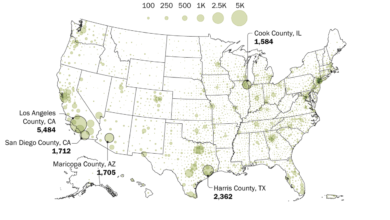

Over the past 40 years, the largest increases in home prices have been concentrated in coastal markets.

Over the past 40 years, U.S. home prices, as measured by the Freddie Mac House Price Index, have risen dramatically by 494%.

Between March 1984 and March 2024, the states with the largest increases in home prices were Washington (828%), Oregon (699%), Rhode Island (668%), Massachusetts (664%), California (664%), Hawaii (639%), Utah (610%), Montana (608%), Idaho (607%), and Maine (605%).

Over the course of 40 years, overall inflation increased by 203%, while the median household income in the U.S. grew by 233%.

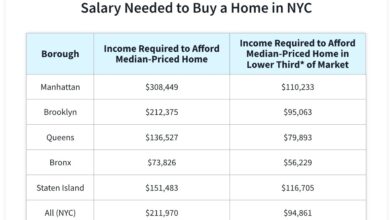

Despite the large gap between national home price growth and inflation/median incomes, housing affordability presents a different picture. Traditional measures of housing affordability, which factor in mortgage rates, median incomes, and national home prices, indicate that in 2024, the situation is only slightly worse than it was in 1984. This is particularly true for buyers financing their home purchases, though those who could afford to pay all-cash in 1984 had a significant advantage over all-cash buyers in 2024.

The similarity between housing affordability in 1984 and 2024 is more apparent than income and price comparisons alone would indicate, mainly due to mortgage rates. In 1984, the average 30-year fixed mortgage rate ranged from 13.0% to 15.0%, while in 2024, it is around 7.0%. However, if you factor in other expenses such as property taxes, home insurance, and down payment size, housing affordability in 2024 may be slightly worse than traditional affordability metrics suggest.

It’s important to recognize that state-level home prices haven’t increased in a smooth, consistent manner over the past 40 years; there have been fluctuations along the way. Additionally, while national home prices have surged by 494% over the past four decades, there’s no guarantee that the next 40 years will follow the same trend.