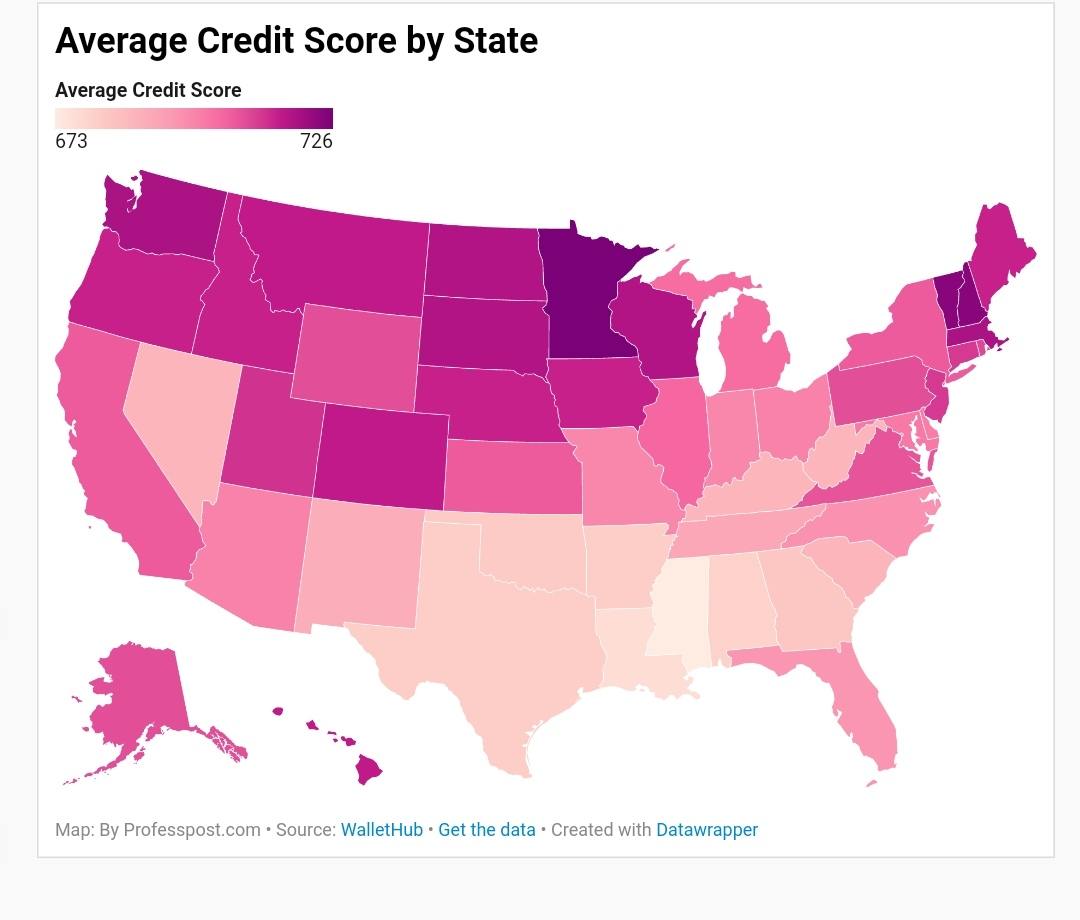

Average Credit Scores Across U.S. States and Largest 50 Cities

Achieving a good credit score is crucial, and a score of 700 or higher (within the 300 to 850 range) is generally deemed favorable. In the U.S., the average credit score stands at 696 according to VantageScore and 714 according to FICO. This implies that, on average, Americans maintain a good credit standing. Understanding these benchmarks is essential for financial well-being and responsible credit management.

Minnesota boasts the highest average credit score in the United States, standing at an impressive 726 as of the first quarter of 2023, according to WalletHub’s November report. This Midwestern state outshines all others, including those on the East and West coasts, showcasing a robust credit profile among its residents.

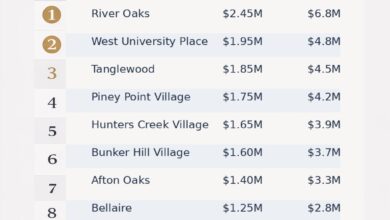

Average Credit Score by City

San Francisco boasts the highest average credit score among the top 50 cities, standing at an impressive 733. On the flip side, San Diego and Colorado Springs hold the lowest averages, with scores of 524 and 498, respectively. Explore your city’s credit score below, comparing it to both the statewide and national averages, with the U.S. national average settling at 696.

What makes having an ‘ideal’ credit score less crucial?

FICO’s scoring model ranges from 300 to 850, serving as a metric for lenders to assess your debt management and lending risk. In Mississippi, where the average credit score is 673, though comparatively lower than other states, it is considered a good score by Experian

Experian classifies credit scores into distinct ranges, each indicative of a different level of creditworthiness:

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Exceptional: 800 to 850

Maintaining a strong credit score can lead to long-term savings. A high credit score indicates to lenders that you are a reliable borrower, increasing the likelihood of securing favorable interest rates for mortgages or credit cards.