State Farm Stops Accepting New Customers Due to Increasing Catastrophic Risks – Who’s Impacted?

The EPA has stated that the increasing global temperatures are exacerbating wildfires. In response to this and other related factors, State Farm, a major insurer, has declared that it will cease offering homeowner’s insurance to new applicants in California, which is prone to wildfires.

The EPA notes that wildfire-affected areas have been on the rise since the 1980s, with the past two decades witnessing the ten most destructive years due to dry plants from droughts, causing increased damage. Although the entire U.S. is impacted, California stands out for its annual wildfires and resulting smoke. This year has proven exceptionally challenging for the state due to a harsh combination of storms, floods, drought, and fires.

According to Axios, State Farm decided to halt applications in California in May, citing “historic increases in construction costs surpassing inflation” and a “rapidly growing catastrophe exposure” as reasons for this move.

Rising Insurance Risks: The Growing Challenge of Coverage in a Changing Climate

Homeownership in California is becoming a riskier endeavor as affordable property coverage becomes increasingly scarce. This predicament poses a severe threat to residents who could potentially lose everything in the face of wildfires. While existing policyholders still enjoy protection, State Farm, one of the major insurers, has decided to halt new applications in California.

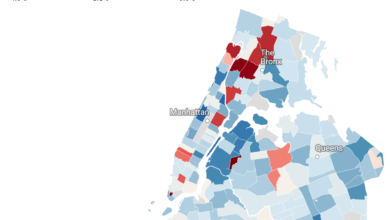

However, this issue transcends the Golden State’s borders. The world is witnessing a surge in the frequency and intensity of various disasters, fueled by the destabilizing effects of rising global temperatures. If insurers perceive these disaster-prone regions as too precarious, an unsettling trend may emerge – more and more areas left without insurance coverage.

Louisiana and Florida are already grappling with dwindling coverage due to predictions of active hurricane seasons, as reported by Axios. Intriguingly, State Farm has pledged to maintain its presence in Florida, despite significant competitors like Farmers and AAA retreating from the market.

What’s being done?

Michael Soller, California’s Deputy Insurance Commissioner, emphasized the California Department of Insurance’s commitment to safeguarding consumers over the long term. He noted that while they’ve faced major wildfires in the past, what sets this situation apart is their proactive approach.

They are implementing the first-ever insurance discount program for wildfire safety and benefiting from substantial wildfire mitigation investments from the Legislature and Governor. Essentially, the CDI is collaborating with the state government to lower insurance expenses and minimize wildfire risks, ensuring insurers can operate securely in the region once more.