Biden’s budget plans to cut the deficit by $3 trillion in the next ten years by imposing a minimum tax of 25% on the richest Americans.

President Biden’s budget proposal, which includes raising revenue by increasing taxes on oil and gas companies and the corporate tax rate, allowing Medicare to negotiate drug prices, and boosting military spending. The budget also includes priorities such as funding for early childhood education and child care, expanding access to affordable insulin, and free community college. However, there is still a standoff with Republicans over lifting the debt ceiling.

On Thursday, President Joe Biden unveiled his budget plans, which include a promise to reduce the federal deficit by $3 trillion in the next ten years. One of the measures proposed to achieve this goal is the implementation of a minimum tax of 25% on the richest Americans.

President Biden’s proposed budget includes measures to increase revenue, such as higher taxes on oil and gas companies, raising the corporate tax rate to 28%, and allowing Medicare to negotiate drug prices. These proposals also provide a glimpse into what may be his platform as a candidate if he runs for re-election in 2024. However, with a Republican-controlled House, it is unlikely that these measures will pass in their current form.

While the President can outline his administration’s priorities for the upcoming year through the budget, Congress has the final say on where funds are allocated.

Shalanda Young, the director of the White House Office of Management and Budget, stated that the current administration can reduce the budget deficit by making the wealthy and big corporations pay their fair share and by cutting unnecessary expenditures on special interests like Big Pharma and Big Oil.

This can be achieved by reforming the tax code to favor work over wealth, and ensuring that no billionaire pays less in taxes than a teacher or firefighter. Additionally, the tax rate on corporate stock buybacks can be quadrupled. Young pointed out that this approach is significantly different from that of congressional Republicans.

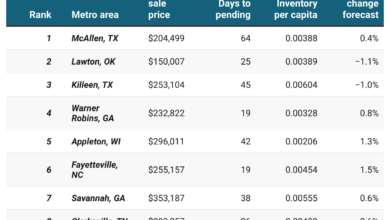

Here are Details of Biden’s fiscal year 2024 budget plan

The Biden administration’s fiscal year 2024 budget proposal benefits from the progress made in controlling the COVID-19 pandemic, reducing the need for emergency aid. The White House intends to prioritize early childhood education and child care funding, expand access to affordable insulin for all Americans, and provide free community college. These proposals aim to provide American families with more financial breathing room.

Chair of the Council of Economic Advisers, Cecilia Rouse, stated that the administration views social programs as economic boosters. Policies like paid leave and child care can increase productivity by attracting more workers into the labor force. Furthermore, investments in early education, mental health, and community college can improve the economy’s long-term productive capacity.

To address potential concerns from Republicans, Rouse noted how the White House has surpassed economic expectations. Despite predictions of rising unemployment, the unemployment rate declined in January and is expected to continue to improve. Rouse highlighted the administration’s success in improving the economy to ease recession concerns.

Source of information : CNBC Economy and Bloomberg US