Collective Investment Trust (CIT): A $7 Trillion Market Quietly Replacing Mutual Funds

Collective Investment Trusts (CITs) are rapidly becoming a core part of the U.S. retirement system, with assets approaching $7 trillion. While many investors are familiar with mutual funds, fewer understand how CITs work or why they are increasingly replacing traditional fund structures in 401(k) plans.

What Is a Collective Investment Trust (CIT)?

A collective investment trust (CIT) is a pooled investment fund managed by a bank or trust company. It is typically offered only within employer-sponsored retirement plans such as 401(k)s and pensions.

CITs function similarly to mutual funds, allowing investors to pool assets into a diversified portfolio. However, they are designed for institutional use rather than individual retail investors.

- Managed by banks or trust companies

- Available only in retirement plans

- Focused on cost efficiency

- Not publicly traded

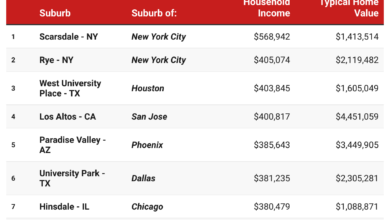

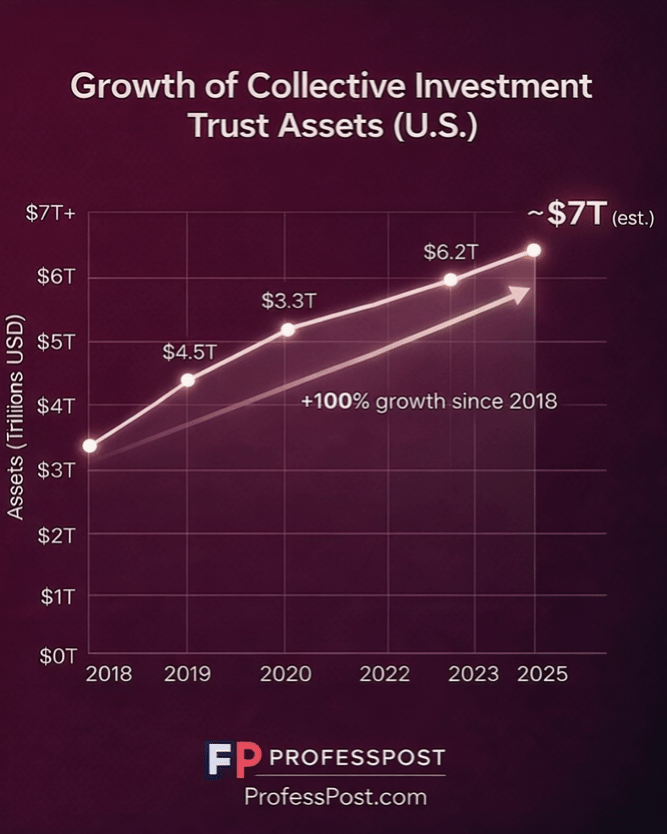

How Large Is the CIT Market?

The growth of CITs has been significant over the past decade:

- 2018: ~$3.0 trillion

- 2020: ~$4.5 trillion

- 2021: ~$5.3 trillion

- 2023: ~$6.2 trillion

- 2025: ~$7 trillion (estimated)

This rapid expansion reflects a broader shift toward lower-cost investment structures within retirement plans.

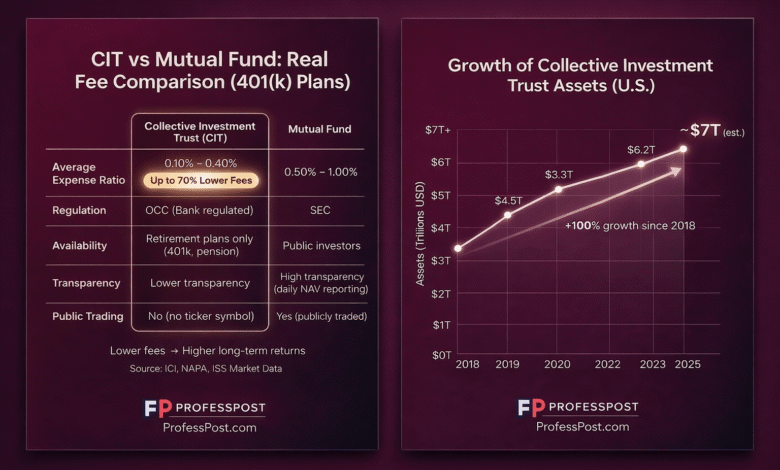

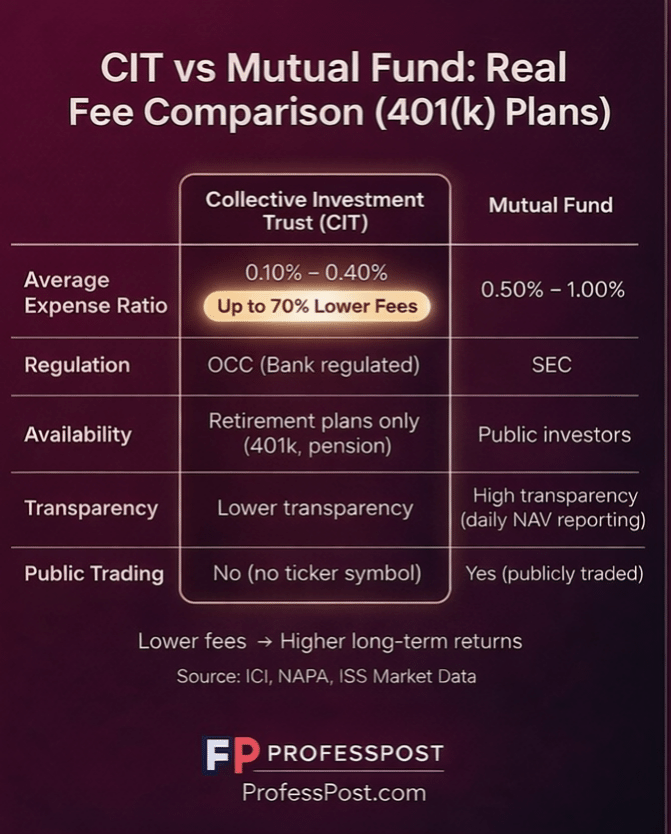

CIT vs Mutual Funds

The primary differences between CITs and mutual funds come down to structure, regulation, and cost:

- Fees: CITs typically range from 0.10%–0.40%, while mutual funds often range from 0.50%–1.00%

- Regulation: CITs are regulated by banking authorities (OCC), while mutual funds are regulated by the SEC

- Availability: CITs are limited to retirement plans, while mutual funds are publicly available

- Transparency: CITs offer less public reporting compared to mutual funds

- Trading: CITs are not publicly traded and do not have ticker symbols

Why CITs Are Replacing Mutual Funds

Lower Fees

CITs eliminate many of the costs associated with retail investing, such as marketing and distribution. As a result, they offer significantly lower expense ratios.

Institutional Efficiency

Because CITs are designed for institutional investors, they can operate with fewer regulatory and administrative costs, improving overall efficiency.

Employer Incentives

Employers managing retirement plans are increasingly focused on reducing fees and improving outcomes for participants. CITs help achieve both goals.

Limitations of CITs

Despite their advantages, CITs have some limitations:

- Less transparency compared to mutual funds

- No ticker symbol or public listing

- Limited access outside retirement plans

Conclusion

Collective Investment Trusts are no longer a niche product. As they approach $7 trillion in assets, they are becoming a dominant force in retirement investing. Their lower costs and institutional structure make them an increasingly attractive alternative to mutual funds within 401(k) plans.

Related Articles

How Much Passive Income You Can Earn From $500K, $1M, and $2M in Investments (2025)

How Each U.S. State Taxes Social Security, Pensions, and 401(k) Withdrawals

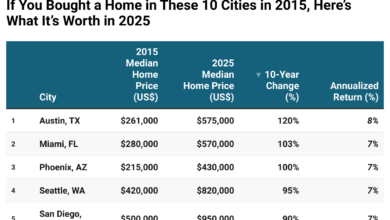

How Much You’d Earn If You Bought Property in 10 Major Cities 10 Years Ago