Home Insurance in Massachusetts: Costs, Trends, and County Comparisons (2020-2023)

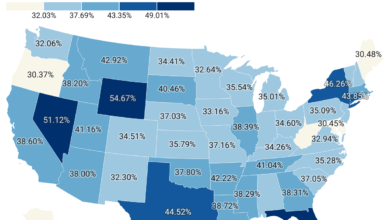

Home insurance in Massachusetts has seen notable changes in median annual premiums across counties between 2020 and 2023.

These shifts highlight the importance of understanding regional trends and identifying opportunities for savings when choosing the right coverage. Below, we analyze premium costs, trends, and county comparisons to help you navigate the evolving home insurance landscape.

County-Level Premium Trends

A review of Massachusetts counties reveals varying levels of increase in home insurance premiums over the past three years:

- Berkshire County saw the steepest rise, with premiums increasing by 27.5%, from $1,317.28 in 2020 to $1,679.98 in 2023.

- Hampden County experienced a more moderate increase of 16.1%, with premiums growing from $1,341.32 to $1,557.84.

- Hampshire County recorded a similar trend, with a 15.5% increase, bringing premiums from $1,431.04 to $1,653.46.

- Essex County, known for its higher baseline premiums, saw a rise of 14.9%, jumping from $1,742.60 to $2,001.44.

- Franklin County had the smallest increase, at just 5.9%, making it a more budget-friendly option with premiums moving from $1,464.55 to $1,550.58.

Berkshire and Essex counties saw the most significant growth in premiums, potentially reflecting higher property values or increased risks. On the other hand, Franklin County’s relatively small increase makes it an appealing option for homeowners seeking cost-effective insurance.