Home Insurance in Washington State: Costs, Trends, and County Comparisons

Over the past few years, many housing markets have experienced a home insurance shock. Part of this is due to insurance models reassessing disaster risks, while much of it stems from rising housing and construction costs.

Home insurance is a vital consideration for homeowners in Washington State, where premiums vary significantly by region. If you’re curious about how much is home insurance in Washington State, seeking the cheapest home insurance in Washington State, or wondering which county has the highest premiums and what county has the lowest premiums, this article covers all the key insights from 2020 to 2023.

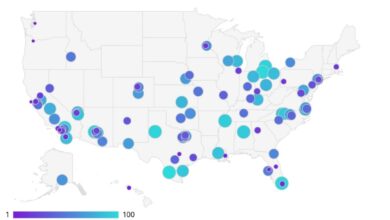

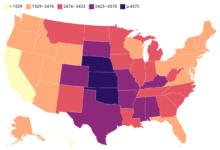

Economists Benjamin Keys, a professor specializing in real estate economics at the Wharton School of the University of Pennsylvania, and Philip Mulder, a professor of insurance at the University of Wisconsin-Madison, collaborated on a research paper published this summer through the National Bureau of Economic Research (NBER). Their analysis was based on raw data sourced from CoreLogic.

According to their research the three-year shift in the median annual Washington State home insurance premium from 2020 to 2023 was 15.0%.

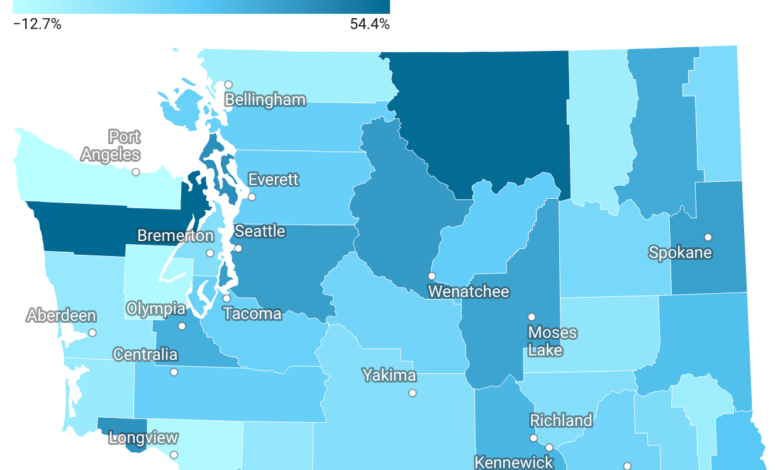

The interactive map below shows the counties that have experienced the largest increases in home insurance premiums during that time period.

Premium Trends Across Washington State

Home insurance premiums have changed dramatically across Washington State in recent years. While some counties have seen sharp increases, others offer more affordable and stable options:

- Clallam County: This county saw a significant 12.7% decrease, with premiums dropping from $1,247.33 in 2020 to $1,088.82 in 2023. Clallam stands out as a potential spot for the cheapest home insurance in Washington State.

- Jefferson County: In contrast, Jefferson County experienced a steep 54.4% increase, with premiums rising from $1,093.65 to $1,688.79. This highlights the range of costs when considering how much is home insurance in Washington State.

- Grays Harbor County: Stability defined Grays Harbor’s market, with a modest 1.2% increase. Premiums rose slightly from $1,229.96 to $1,244.23, offering consistency to homeowners.

- King County: Premiums in King County climbed by 35.3%, increasing from $1,390.80 in 2020 to $1,882.00 in 2023. This reflects the challenges of insuring houses in a densely populated urban area.

- Mason County: A 8.9% drop in premiums brought costs down from $1,644.68 to $1,498.78, making it a more affordable choice for homeowners in the region.

What County Has the Lowest Premiums?

For homeowners searching for the cheapest home insurance in Washington State, Franklin County tops the list. The median premium here was $1,060.42 in 2023, despite a small 7.4% increase from 2020. Franklin County remains the most budget-friendly option statewide.

Which County Has the Highest Premiums?

On the other end of the spectrum, Garfield County recorded the highest home insurance premiums in Washington State. The median premium reached $2,027.67 in 2023. However, it’s worth noting that premiums in Garfield County actually decreased slightly by 1.5% since 2020, demonstrating a relatively stable market.