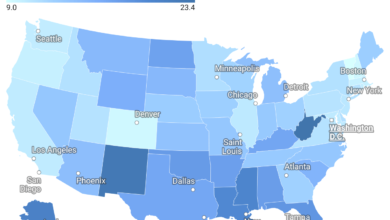

How Much Credit Card Debt U.S. Cities Owe: Per Household and Overall Totals

Credit card debt across 182 major U.S. cities, including the 150 largest, reveals which communities carry the heaviest financial burdens and face economic challenges.

Americans currently carry about $1.36 trillion in credit card debt, averaging roughly $10,800 per household. This total is expected to rise by another $100 billion this year, highlighting the growing problem of overspending.

Charging more than you can afford on credit cards can lead to high interest charges and harm your credit score. Cities with the highest credit card balances face significant financial challenges. To pinpoint the U.S. cities with the highest and lowest credit card debt, WalletHub analyzed data from over 180 cities using the latest information from TransUnion and the Federal Reserve.

Santa Clarita, CA, holds the highest average credit card debt per household, with each owing about $21,625. Altogether, residents carry more than $1.6 billion in credit card debt. Interestingly, Santa Clarita also led the nation in paying down household debt during the first quarter of 2025. With a median income well above the national average, it suggests many residents have substantial credit limits and the means to manage high spending.

Chula Vista, CA, ranks second for average household credit card debt at $20,837, totaling around $1.8 billion citywide. Similar to Santa Clarita, Chula Vista is a relatively affluent city where many can handle significant credit card balances. Residents here paid off the seventh-highest amount of household debt in Q1 2025. The city also experiences lower financial distress among its population, ranking 63rd out of 100 large cities for debt delinquency.

New York City comes in third, with an average household credit card debt of $19,540. Collectively, New Yorkers owe nearly $65 billion in credit card debt. While the city ranks 47th in the amount of debt paid off during Q1 2025 among over 180 large U.S. cities, it also faces higher financial challenges. New York has the 13th-largest share of residents in financial distress and ranks 48th for debt delinquency.