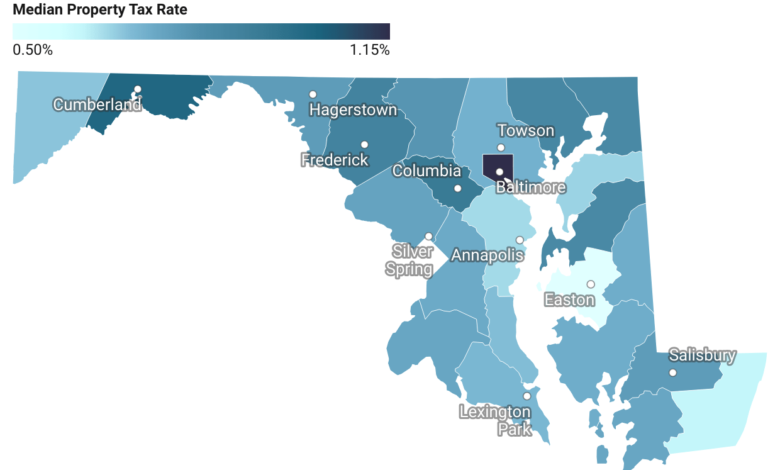

Maryland Property Tax Rates by County for 2025

The median annual property tax in Maryland is $2,774 for a home with a median value of $318,600. On average, counties in Maryland levy property taxes at a rate of 0.87% of a property’s assessed fair market value each year.

Maryland has one of the highest average property tax rates in the United States, with only ten states imposing higher rates.

The state’s median household income is $86,881 annually, and the median yearly property tax paid by residents accounts for approximately a certain percentage of that income. This places Maryland 19th among all 50 states for property taxes as a percentage of median income.

Property tax rates in Maryland vary by county. Howard County has the highest average property taxes in the state, with residents paying an average of $4,261 annually (0.93% of the median home value). In contrast, Garrett County has the lowest property taxes, with an average annual payment of $1,173 (0.69% of the median home value).