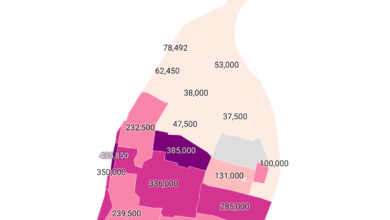

Median Home Sale Price & Number of Homes Sold by ZIP Code in the Bay Area, California in February 2025

This article takes a closer look at the Bay Area real estate market in February 2025, exploring trends in home prices and sales across different ZIP codes.

The Bay Area housing market in February 2025 saw increased sales activity but a slight dip in median home prices. Home sales rose 3.5% year-over-year, while the median price declined 0.5% to $1,250,000—still far above the national median of $398,400. This contrasts with statewide and national price increases, highlighting the region’s unique economic and social influences.

Following a seasonal slowdown in December, real estate activity rebounded with more listings and contract signings. Interest rates for 30-year fixed-rate jumbo mortgages dipped below 7%, but consumer confidence remained cautious due to recent California wildfires and broader political instability, potentially impacting market momentum.

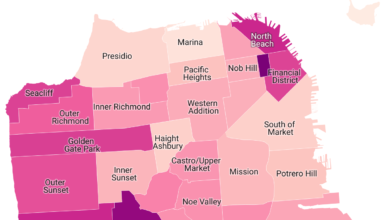

ZIP Codes with the Highest Median Sale Prices

In February 2025, several Bay Area ZIP codes saw exceptionally high home sale prices. Atherton (94027) led with a median of $7,457,000, known for its exclusivity and large estates. Los Altos Hills (94022) followed at $4,780,000, offering scenic properties and top-rated schools. Los Altos (94024) also had a high median of $5,051,000, with a charming downtown and ample parks.

Burlingame (94010) reached $4,050,000, benefiting from its prime location between San Francisco and Silicon Valley, as well as excellent schools. Menlo Park (94025), with a median of $2,775,000, rounds out the top five, driven by its strong ties to the tech industry and its central location.

ZIP Codes with the Lowest Median Sale Prices

Several ZIP codes in February 2025 have lower median home sale prices. 95690 (Walnut Grove) in Sacramento County has the lowest at $150,000, influenced by its rural location and lower median income. 93635 (Los Banos) in Merced County follows at $490,636, with affordable housing due to its Central Valley setting.

95419 (Nice) in Lake County has a median of $260,000, offering a rural environment with many retirees. 95322 (Patterson) has a median price of $392,500, reflecting its agricultural community and distance from Bay Area hubs.

94571 (Rio Vista) in Solano County has a median of $451,250, driven by its rural character. 94603 (Oakland) has a median of $540,000, influenced by neighborhood and socioeconomic factors. Lastly, 94509 (Antioch) in Contra Costa County has a median price of $520,000, benefiting from its affordability compared to the Bay Area.

ZIP Codes with the Highest Number of Sales

In February 2025, several ZIP codes saw high home sales. 95687 (West Sacramento) led with 135 homes sold, thanks to affordable housing and new construction. 94513 (Concord) followed with 131 homes, offering affordable options and desirable amenities.

In San Jose, 95125 recorded 104 sales, driven by tech demand and new housing. 94501 (Antioch) and 94558 (Pittsburg) had 76 and 110 sales, respectively, due to their affordable homes and new developments.

San Bruno (94066) saw 68 sales, benefiting from its proximity to San Francisco and Silicon Valley. Lastly, 94110 (San Francisco) had 84 sales, reflecting strong buyer interest in the city’s popular residential areas.

ZIP Codes with Very Low Number of Sales

Several ZIP codes in the February 2025 data recorded very low home sales, with only one or two transactions. ZIP codes like 94018 (El Granada), 94020 (La Honda), 94508 (Angwin), and 94933 (Forest Knolls) reflect small populations, rural areas, or older communities, leading to limited sales activity. For example, El Granada, a small affluent area, and La Honda, a rural region with many seniors, both saw minimal turnover, as did Angwin and Forest Knolls, with stable, low-turnover populations.

Similarly, high-end or established neighborhoods like 94957 (Ross) and 94074 (Los Altos Hills) also recorded very low sales due to limited inventory and affluent residents with low turnover. ZIP codes like 94592 (Vallejo) and 94601 (Oakland) show the potential for unique or small geographic areas within larger cities, where sales volume is limited by housing stock or specific market segments. In general, low sales volumes often stem from small populations, affluent communities, or specialized housing markets.