Renting vs. Buying in NYC (2025): How Housing Costs by Borough Change the Math

In New York City, the decision to rent or buy isn’t about taxes, borough rules, or city policy — those are the same everywhere. What does change dramatically is housing cost, and that alone can determine whether buying builds wealth or quietly destroys it.

In 2025, NYC’s rent-vs-buy decision is one of the most misunderstood personal finance choices in America.

This article breaks down the real math, explains why NYC is different from most U.S. cities, and shows how housing prices by borough affect break-even timelines — without implying different tax systems.

Why NYC Is a Special Case

In most American cities, buying tends to outperform renting within a few years. NYC breaks that rule because of: Extremely high purchase prices, Large required down payments, HOA and co-op fees, High transaction costs and Long break-even timelines. In other words, ownership has a much higher hurdle to clear in NYC than elsewhere.

What Boroughs Do — and Do Not — Change

Let’s be explicit:

Boroughs do NOT change : Income taxes, Property tax rules, Mortgage rates and Legal or regulatory structure

Boroughs DO change : Purchase prices, Rent levels, Down payment size, Monthly ownership costs and Time required to break even. That difference alone can shift the rent-vs-buy outcome by years.

Renting vs. Buying in NYC: Key 2025 Assumptions

This analysis uses conservative, NYC-realistic assumptions:

- Mortgage rate: ~6.5%

- Down payment: 20%

- Investment alternative return: ~6% annually

- Time horizon: 5–15 years

The goal isn’t to predict prices — it’s to compare net-worth outcomes.

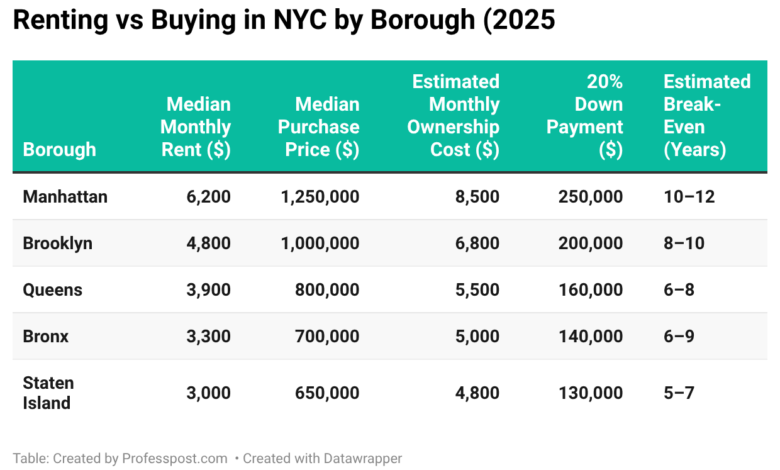

NYC Borough Comparison: Rent vs Buy Economics

Below is an interactive comparison table showing how housing costs change the rent-vs-buy math across NYC boroughs.

Why the Down Payment Changes Everything

The biggest hidden cost of buying in NYC isn’t the mortgage — it’s the opportunity cost of the down payment.

Example:

- Manhattan down payment (20%): ~$250,000

- Queens down payment (20%): ~$160,000

That $90,000 difference, invested at 6% for 10 years, grows to ~$160,000. Buying only makes sense if: Appreciation, Forced equity And rent savings beat that alternative.