Salary vs. Hourly Pay: What You Need to Know

Here’s what you need to know about how these two common pay structures differ.

Salaried positions provide the stability of a fixed paycheck, often along with access to employer-sponsored benefits and opportunities for career growth. In contrast, hourly employees are eligible for overtime pay when working more than 40 hours a week, a benefit not typically available to salaried workers. When choosing between hourly and salaried pay, it’s important to consider your usual work hours, the likelihood of earning overtime, and the overall value of benefits such as health insurance and paid leave.

What Is Salary vs. Hourly Pay?

Salary and hourly pay are two common methods of employee compensation. Certain roles are more likely to be salaried, and it’s important for employers to clearly outline the payment structure in the employment contract.

Salaries are typically offered to full-time employees and are paid as a fixed amount on a biweekly or monthly basis. While many companies use structured salary ranges for each position, others may be more flexible and negotiate compensation during the hiring process.

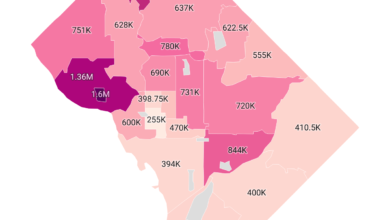

A candidate’s education, professional background, and work experience often influence the salary offered. Additional factors—such as job level, position classification, and geographic location—can also impact the final salary decision.

Hourly pay, also known as an hourly rate, means employees are compensated for each hour they work. If you are paid hourly, it’s important to understand exactly how much you will earn for every hour on the job.

Your hourly wage may be based on either your state’s minimum wage or the federal minimum wage, depending on the job. For instance, in Texas, the minimum wage is $7.25 per hour, which matches the federal rate. However, employers can offer higher hourly rates, and in some cases, you may be able to negotiate a better pay rate.

To calculate your earnings with hourly pay, multiply your hourly rate by the number of hours worked. For example, if you work 10 hours at $20 per hour, you’ll earn $200. The more hours you work, the more income you generate. In contrast, salaried employees typically receive a fixed amount of pay regardless of how many hours they work.

Pros and Cons of Salary vs. Hourly Pay

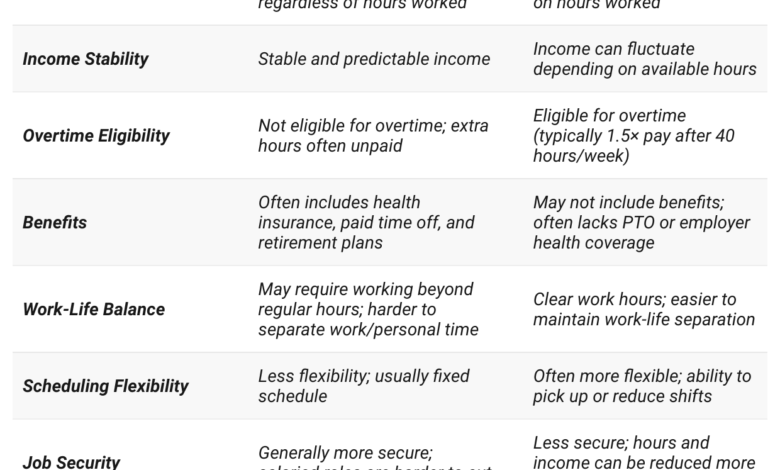

When choosing between salary and hourly pay, employees should weigh their personal needs against the pros and cons of each structure. Salaried positions offer the stability of a consistent paycheck, access to benefits like health insurance and paid time off, and better potential for career advancement. This setup is ideal for those who value financial predictability and long-term job growth, though it often involves working more than 40 hours a week without extra compensation.

Hourly pay, on the other hand, provides compensation for every hour worked, including overtime and holiday pay, which can lead to higher earnings for those putting in extra time. It also often offers more flexible scheduling, making it a good fit for workers who want greater control over their hours. However, hourly employees may miss out on benefits, have less job security, and face income instability if hours are cut or shifts are reduced.

Ultimately, the decision comes down to what matters most: the stability and benefits of salaried roles or the earning potential and flexibility of hourly work. Each structure has trade-offs, and understanding them can help workers align their compensation with their lifestyle and financial goals.