The New Retirement Plan for the Middle Class: Working Into Later Years

A new insight into the perspectives of middle-class Americans on retirement is uncovering some surprising opinions about their life expectancy and plans to continue working.

According to a study by the Transamerica Center for Retirement Studies and the Transamerica Institute, about half of middle-income Americans currently employed expect to continue working beyond the age of 65. While many express a preference for this, approximately 80% mention financial challenges as a key reason, including inadequate savings and concerns that Social Security may not offer sufficient financial support.

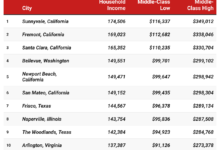

Transamerica defines the “middle class” not by a strict income threshold but as a broad sociological category, encompassing individuals earning between $50,000 and $200,000 per year. This group represents about 55% of U.S. adults.

Catherine Collinson, CEO of Transamerica Institute, shared with CBS MoneyWatch, “While many are saving for retirement, the key question is whether they are saving enough.”

The Challenges of Extended Lifespan

Middle-class households have saved a median of $66,000 in retirement accounts, according to a survey. However, as this savings grows, it may not be enough to sustain a retirement based on an individual’s current age and lifestyle. This amount is also far below the $1.5 million that the typical worker believes is necessary for a comfortable retirement, as revealed in a Northwestern Mutual study earlier this year.

Despite this, the number of 401(k) millionaires—those with at least $1 million in their retirement accounts—has recently reached a record high, thanks to strong stock market gains, according to new data from Fidelity. However, this still represents only around 500,000 accounts, a small fraction of the approximately 160 million people in the U.S. labor force.

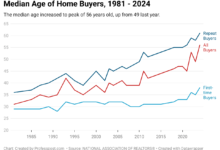

At the same time, many middle-class workers are planning for retirements that could last 25 years or more, driven by expectations of living until a median age of 90. A longer retirement requires saving more money to cover those additional years outside the workforce.

“Longer life expectancies are causing people to rethink their life plans, particularly the balance between time spent working and time spent in retirement,” said Collinson. “Many people are considering working longer and delaying retirement to earn more income and save, while others are planning to support longer retirements.”