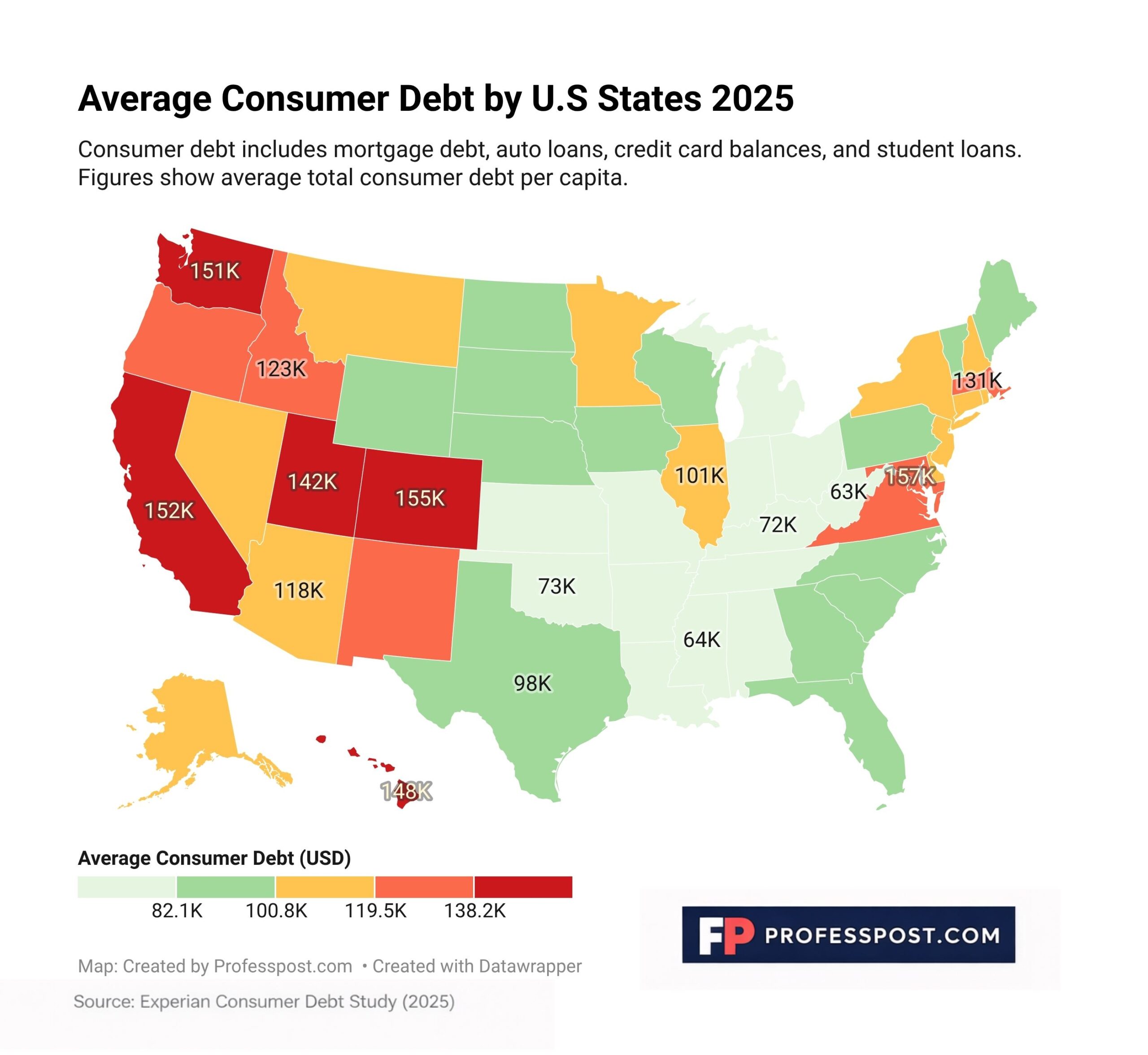

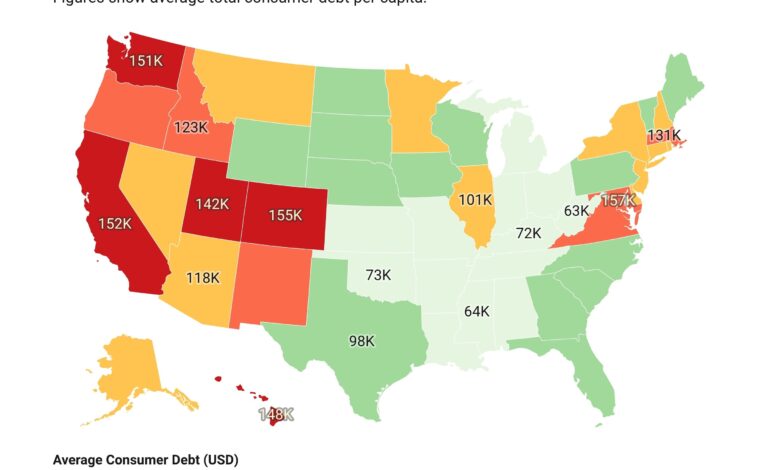

Average Consumer Debt by U.S. State

Consumer debt includes major categories such as mortgage debt, auto loans, credit card balances, and student loans. The figures represent average total consumer debt per person and are not adjusted for income or cost of living.

States Ranked by Average Consumer Debt (Highest to Lowest)

- District of Columbia – $156,868

- Colorado – $155,204

- California – $151,749

- Washington – $151,068

- Hawaii – $148,442

- Utah – $141,779

- Massachusetts – $130,772

- Maryland – $128,998

- Virginia – $126,747

- New Mexico – $124,000

- Idaho – $123,463

- Oregon – $123,104

- Nevada – $118,880

- New York – $118,000

- Arizona – $117,978

- Alaska – $117,030

- Rhode Island – $112,000

- Connecticut – $110,272

- New Jersey – $109,831

- New Hampshire – $107,965

- Delaware – $106,512

- Minnesota – $105,918

- Montana – $104,812

- Illinois – $101,000

- Iowa – $100,000

- Texas – $97,767

- North Carolina – $97,645

- Florida – $97,147

- Wyoming – $95,000

- Georgia – $94,888

- South Carolina – $94,196

- South Dakota – $92,612

- North Dakota – $90,555

- Vermont – $89,972

- Maine – $89,510

- Nebraska – $85,744

- Wisconsin – $85,354

- Pennsylvania – $83,483

- Tennessee – $82,000

- Missouri – $81,656

- Kansas – $80,485

- Indiana – $79,048

- Louisiana – $77,868

- Alabama – $77,814

- Michigan – $76,414

- Arkansas – $74,716

- Ohio – $74,140

- Oklahoma – $73,192

- Kentucky – $71,816

- Mississippi – $64,241

- West Virginia – $63,441

What explains the differences?

States with the highest consumer debt are often places where housing is expensive and mortgages make up a larger share of total borrowing.

In lower-debt states, housing costs tend to be lower, so residents often carry smaller mortgage balances.

That said, lower debt doesn’t automatically mean households are better off—it can also reflect lower home values and fewer credit-based investments.

section>

Methodology

Values represent average total consumer debt per person by state for 2025, based on aggregated credit reporting data.

Consumer debt includes major categories such as mortgage debt, auto loans, credit card balances, and student loans.

Related reading on ProfessPost