Although the average American makes about $48,060 annually, HENRYs (“high earners, not rich yet”) feel that true wealth requires having $4.5 million in net assets.

Forget the comfort often associated with a six-figure salary. An increasing number of affluent professionals, called HENRYs (“high earners, not rich yet”), argue that making $750,000 a year isn’t sufficient to eliminate financial stress. Despite their high incomes and lifestyles far beyond the average, these earners have relatively low savings and don’t consider themselves truly rich.

Business journalist Shawn Tulley first introduced the acronym HENRY in 2003 and recently noted that, when adjusted for inflation, today’s HENRYs earn between $375,000 and $750,000 annually. But how much wealth does it take to be considered rich by HENRYs? According to Tulley, wealth isn’t just about income—it’s measured by net worth, including savings in cash, stocks, bonds, and home ownership. To be seen as “rich” today, one would need approximately $4.5 million in net assets.

The Bureau of Labor Statistics reports that the typical American income is around $48,060 annually. Although it might seem surprising that HENRYs—those earning high incomes—don’t view themselves as wealthy, this group offers valuable insight into today’s economic realities.

The term HENRY has become increasingly popular in recent years as high earners encounter various financial challenges while possessing significant purchasing power, according to Gideon Drucker, CEO of Drucker Wealth, a financial firm dedicated to managing HENRY clients’ wealth.

A couple in their late thirties living in New York, with two children and a combined income of $600,000, faces the challenge of balancing significant expenses. Despite their strong earnings, they manage high costs they consider essential: private school tuition, costly rent in a desirable neighborhood, and ongoing savings for both college and retirement.

Drucker describes HENRYs as the “working rich” — individuals who depend more on their high income than on accumulated wealth. Their strong earning power combined with an aspirational lifestyle makes them an attractive and valuable market segment.

“They earn enough to cover daily expenses without stress, funding travel, dining out, concerts, and, for those with families, private schooling and camps for their children,” he says. “But the key characteristic of a HENRY is that they don’t yet feel fully prepared financially to achieve their long-term goals.”

According to market researcher Pam Danziger, author of Meet the HENRYs: The Millennials That Matter Most to Luxury Brands, HENRYs are typically well-educated, with many holding master’s degrees or advanced qualifications in technical fields. Danziger notes that this group tends to value experiences more than material goods. For example, they often prioritize investing in their children’s education rather than spending on luxury items like high-end vehicles. At the same time, many HENRYs still aspire to own a second home.

Danziger describes HENRYs as typically living a “stable, normal American lifestyle,” which often includes being married, raising children, and owning a home. She considers herself a typical example of this group. She and her husband lead what she calls “a very upper-middle-class life” in a Pennsylvania suburb, where they raised their kids, enrolled them in private schools, provided them with cars, and fully covered their college tuition.

According to Drucker, the main obstacle for HENRYs is the absence of a solid financial strategy to grow their wealth. In his book, How to Avoid H.E.N.R.Y. Syndrome, he describes the “syndrome” as the experience of being trapped in a daily financial cycle—where people can manage their expenses but feel they’re not advancing toward their long-term financial objectives.

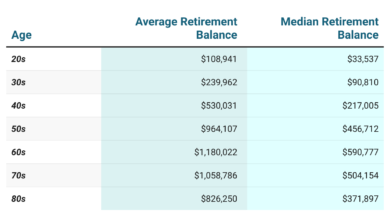

“If you’re earning $40,000 a month, you might not really know where all your money is going. That could be fine for now, since it’s clearly enough to cover your current desires,” Drucker explains. “But if you’re making $40,000 and spending $32,000, are you truly saving enough to eventually retire and sustain your lifestyle?”

Drucker’s remedy for HENRY syndrome focuses on gaining organization and clarity. He advises HENRYs to establish clear financial goals, monitor their cash flow and expenses closely, and automate their savings.