Goldman Sachs is implementing job cuts once again due to a decline in Wall Street deals

Goldman Sachs, in response to a decline in deals activity, is making preparations for its third round of layoffs since September. The bank is anticipated to reduce its workforce by fewer than 250 positions in the upcoming weeks, as per an individual familiar with the company’s plans.

Goldman Sachs, a New York-based bank, is getting ready for its third round of layoffs in response to a decline in deals activity since September. In the upcoming weeks, the company is anticipated to reduce its workforce by fewer than 250 positions, according to a source familiar with the matter.

Goldman Sachs, led by CEO David Solomon, was one of the first major Wall Street firms to reduce its workforce in September, eliminating several hundred positions. In January, the company further downsized, resulting in approximately 3,200 job cuts. Similarly, Morgan Stanley recently announced about 3,000 job reductions this month, while JPMorgan Chase trimmed approximately 500 positions.

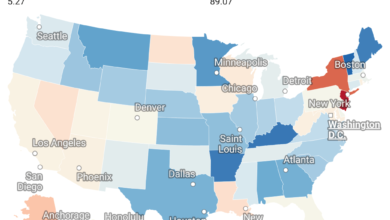

Compared to its competitors, Goldman Sachs is more closely tied to the fluctuations of Wall Street. The company’s combined 16% decline in trading and advisory revenue in the first quarter played a significant role in a disappointing start to the year.

The job cuts at Goldman Sachs will impact managing directors and some partners, as reported by an anonymous source. The Wall Street Journal initially broke the news on Tuesday.

As of March 31, Goldman Sachs had a total of 45,400 employees, which marks a 6% decrease compared to the fourth quarter of 2022.

To provide additional information, it should be noted that JPMorgan Chase recently reduced its workforce by approximately 500 positions last week.