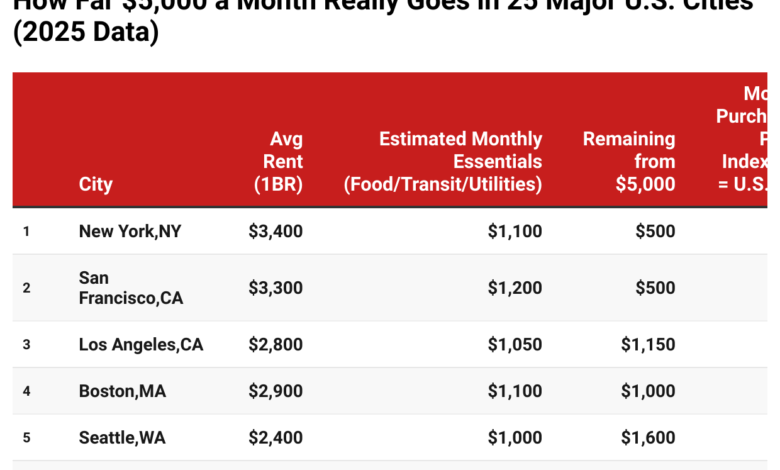

How Far $5,000 a Month Really Goes in 25 Major U.S. Cities

“Earning $5,000/month” doesn’t mean the same thing everywhere. In high-cost cities, it’s a survival salary. In the South or Midwest, it can fund homeownership, vacations, and savings.

The next time someone says, “$60K a year is plenty,” the right response is: “It depends on your city.”

For many Americans, earning $5,000 per month — roughly $60,000 per year after taxes — sounds like a solid middle-class income. But depending on where you live, that same paycheck can buy either a modest apartment and daily stress… or a comfortable lifestyle with plenty left over each month.

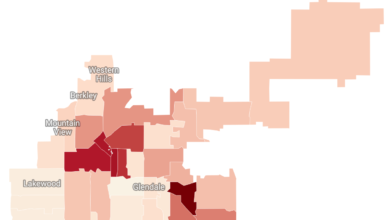

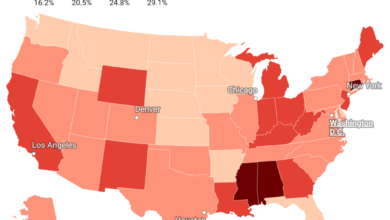

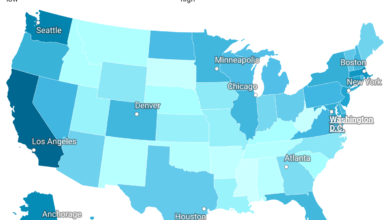

In 2025, the gap between high-cost and low-cost cities has widened dramatically. Rents have risen fastest in coastal metros, while mid-tier cities in the South and Midwest still offer real affordability. Using data from Zillow, BEA, and BLS, we estimated how far $5,000 in monthly take-home pay stretches across 25 major U.S. cities.

- $5,000/month is middle-class in name only in NYC, SF, and Boston — most of it goes to rent.

- In Austin, Denver, and Atlanta, that same income supports a comfortable lifestyle with room for savings.

- No-income-tax states like Texas, Florida, and Nevada stretch your money further.

- Midwestern metros like Kansas City and Omaha offer nearly triple the discretionary income of San Francisco for the same paycheck.

In short, the value of $5,000 a month can swing from barely scraping by to financial ease depending entirely on your ZIP code.