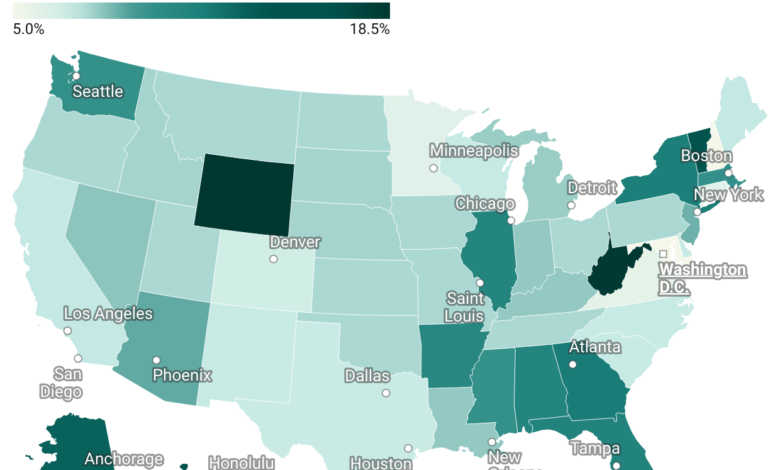

How Health Insurance Costs Stack Up Against Median Household Income Across All U.S. States (2025)

Explore how health insurance costs compare to median household incomes across all U.S. states in 2025, revealing where families face the highest financial healthcare burden.

Healthcare costs in the United States vary widely by state, and understanding how these costs relate to household income is crucial for financial planning. The 2025 data reveals a clear picture of the proportional burden health insurance can place on American families.

According to recent figures, states like Vermont, Hawaii, and Alaska have some of the highest average monthly premiums, with costs exceeding $1,000 per month in some cases. In Vermont, for example, the average monthly premium is $1,157, which constitutes 14.5% of the median household income. Alaska follows closely with an average of $1,088 per month, representing 13.3% of household income. This indicates that residents in these states spend a substantial portion of their earnings on health insurance alone.

Conversely, states such as New Hampshire, Maryland, and Virginia have relatively lower premiums in proportion to income. New Hampshire’s average monthly premium of $325 accounts for only 5% of the median household income, making it one of the most affordable states in terms of health insurance relative to earnings. Similarly, Maryland and Virginia residents spend 5–5.8% of their income on health insurance.

Many states fall somewhere in between these extremes. For instance, California and Colorado have moderate premiums, averaging $462 and $471 per month respectively, which is roughly 7–7.3% of the median household income. Meanwhile, states like West Virginia and Wyoming see higher proportional costs, with health insurance taking up over 18% of the median income, reflecting regional differences in healthcare costs and income levels.

This state-by-state comparison highlights the importance of considering local healthcare costs when evaluating personal finances. Families in states with high premiums relative to income may face tighter budgets, while those in states with lower proportional costs have more flexibility. Additionally, factors such as subsidies, employer contributions, and plan types can further affect the actual out-of-pocket costs for individuals.