How Much Americans Think They Need to Retire in 20 Major U.S. Cities (2025)

Key Insights

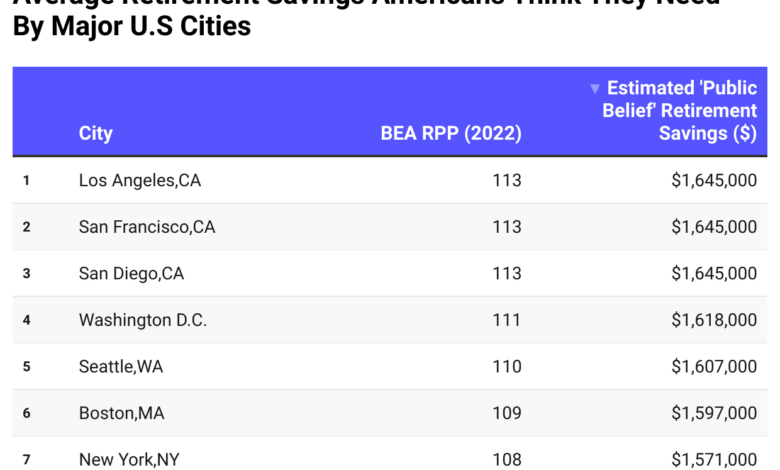

- Coastal cities lead in perceived retirement needs. Residents of San Francisco, Los Angeles, and New York think they’ll need well over $1.6 million to retire comfortably, driven by higher costs for housing, healthcare, and everyday expenses.

- Midwestern and Southern metros report lower expectations. Cities like Columbus, Indianapolis, and Charlotte show expected retirement savings targets closer to $1.3–$1.4 million.

- Sunbelt metros such as Dallas, Houston, and Miami fall slightly below the national “magic number,” showing how locals perceive lower living costs as translating to lower savings requirements.

How much do Americans think they need to retire comfortably? The answer depends not only on age and lifestyle—but also on where they live. According to the Northwestern Mutual 2024 Planning & Progress Study, the average American believes they’ll need about $1.46 million in savings to retire comfortably. But perceptions shift dramatically across the country, especially between high-cost coastal metros and more affordable inland cities.

To reflect these differences, we used cost-of-living data from the U.S. Bureau of Economic Analysis (BEA), specifically its Regional Price Parity (RPP) index, to estimate how much people in each major city think they’ll need based on local prices. If a city is 10% more expensive than average, its residents would likely perceive their retirement goal to be about 10% higher.

Below is a breakdown of 20 major U.S. cities showing the estimated minimum retirement savings that residents believe they’ll need, scaled by local price levels.

What Is BEA RPP (Regional Price Parity)?

Regional Price Parity (RPP) is a measure from the U.S. Bureau of Economic Analysis (BEA) that compares how expensive or affordable it is to live in different areas. The national average equals 100. A city with an RPP of 110 is roughly 10% more expensive than average; a city with 90 is about 10% cheaper.

It reflects differences in housing, goods, and services—offering a more accurate picture of local price levels. For example, if Americans nationally think they need $1.46 million to retire, someone in California (RPP 112.6) would likely believe they need around $1.64 million, while someone in Ohio (RPP 91.8) might say $1.34 million is enough.

These numbers highlight how Americans’ perception of financial security depends on geography. They don’t represent what you should save, but they show how expectations rise or fall with local living costs. For policymakers and financial planners, the gap between what people think they need and what they actually have saved (the average U.S. retirement account balance is under $90,000) underscores a major awareness issue in retirement preparedness.