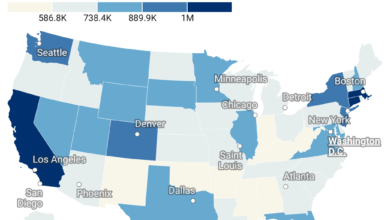

How Much Median-Income Households Pay in Property Taxes Across America’s Biggest Cities

Property taxes can quietly eat into household budgets. Here’s how much of the median income goes to taxes in the 30 largest U.S. cities.

Key Takeaways

- High-Tax Burdens in the Midwest & Texas: Chicago, Houston, and Dallas have moderate home prices, but high property tax rates — meaning middle-income households give up a large portion of their paycheck just to taxes.

- Coastal Cities Aren’t Always the Worst: San Francisco, Seattle, and San Jose may have sky-high home prices, but property taxes are surprisingly less punishing relative to incomes, thanks to lower effective rates.

- The Northeast Struggles With Both Cities like New York, Philadelphia, and Boston combine high housing costs with above-average tax rates, putting steady pressure on homeowners.

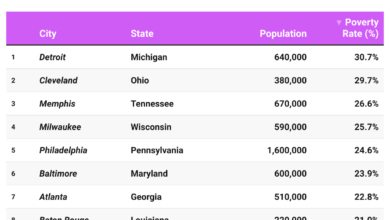

- The Rust Belt’s Tax Squeeze Detroit and Milwaukee stand out: despite relatively low incomes and home prices, their high effective tax rates lead to some of the heaviest burdens in the country.

When people talk about affordability, the conversation usually revolves around home prices and mortgage rates. But there’s another factor that quietly eats into household budgets every year: property taxes.

Unlike rent, property taxes are unavoidable for homeowners, and they vary widely across U.S. cities. In some places, homeowners pay just a small share of their income to taxes, while in others, taxes consume a much larger portion of what households bring in.

To put this into perspective, we looked at the 30 largest U.S. cities and compared:

- The median household income (based on Census data),

- The median home value in that city,

- And the average effective property tax rate.

From there, we calculated how much the typical household would owe in annual property taxes, and what percentage of their income that represents.

Many affordability studies compare home prices to incomes, but rarely include property taxes. For homeowners, though, taxes are one of the largest ongoing costs — often thousands of dollars per year.

By comparing median income vs. property tax burden, we can see which cities give homeowners more breathing room, and which cities place heavier financial pressure on families.

- In Detroit, for example, home values are relatively low, but high tax rates mean homeowners can lose a surprisingly large share of their income.

- Meanwhile, in San Francisco or San Jose, property taxes are based on extremely high home prices, but lower tax rates help offset some of the pain.

- Cities like Chicago, Houston, and Dallas stand out for how property taxes eat a significant share of household income despite being more “affordable” housing markets.