How Much Net Worth You Need to Be in the Top 10% in Chicago (By Area)

Chicago is one of the few major U.S. cities where wealth varies dramatically by neighborhood, not just by income. A household that ranks among the top 10% in one part of the city may be far from it in another.

That makes Chicago a powerful case study for understanding how net worth is distributed locally — and how wealth is actually built.

This article breaks down how much household net worth you need to be in the top 10% in Chicago, by area, and explains what drives those differences.

Why Net Worth Matters More Than Salary

Income alone is a weak signal of wealth — especially in Chicago.

Many households earning $150K–$250K:

- Carry large mortgages

- Have limited investment assets

- Are highly exposed to housing cycles

Net worth matters because it includes:

- Home equity

- Retirement accounts

- Brokerage investments

- Business ownership

This is the metric banks, lenders, and financial advisors actually use.

How “Top 10% Net Worth” Is Defined Here

This analysis estimates the minimum household net worth required to exceed 90% of households within different Chicago areas. Key points;

- Household, not individual

- Assets minus liabilities

- Includes home equity and investments

- Estimates reflect local wealth distributions, not citywide averages

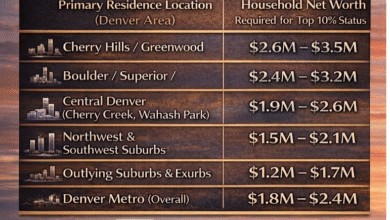

Top 10% Net Worth in Chicago — By Area (2025 Estimates)

Below is a comparison table showing how the top 10% net worth threshold changes across Chicago.

These ranges are illustrative estimates based on housing values, ownership rates, and asset concentration.

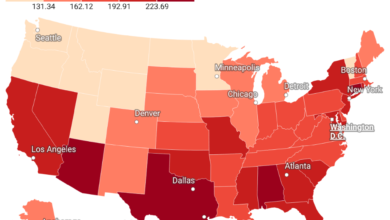

Chicago vs Other Major Cities

- City, Estimated Top 10% Net Worth

- San Francisco $3.5M – $4.5M

- New York City $2.8M – $3.8M

- Chicago $1.6M – $2.0M

- Los Angeles $2.2M – $3.0M

What It Means to Be “Top 10%” in Chicago

Being in the top 10% does not mean: Ultra-luxury lifestyle, Cash-rich balance sheet and Financial independence.

It often means: Paid-down home, Consistent investing and Long time horizons. Chicago wealth is typically equity-driven, not speculative.