Data VisualizationEconomyFinanceUS News

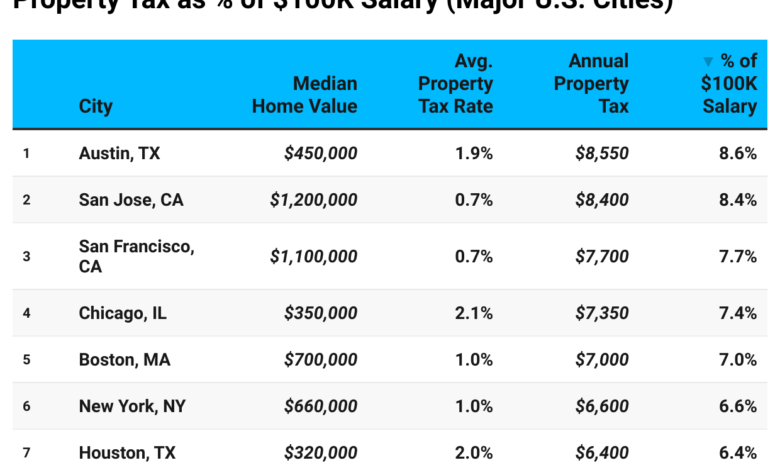

How Much of Your Salary Goes to Property Taxes in the 30 Biggest U.S. Cities

When we think about how far a salary can stretch, most of us focus on income tax and cost of living. But there’s another factor that quietly eats away at your paycheck: property taxes.

Key Takeaways:

- Texas is a double-edged sword: With no state income tax, Texas looks great on paper — but sky-high property tax rates make cities like Austin, Dallas, and Houston surprisingly expensive for homeowners.

- California’s “low rate, high value” problem: Rates are lower (around 0.7–0.8%), but home prices are so inflated that the actual dollar amount of property tax is among the highest in the nation.

- Midwestern squeeze: Cities like Chicago and Milwaukee have some of the highest effective rates, eating up more salary despite lower home values.

- Southern advantage: Cities like Nashville, Jacksonville, and Memphis offer relatively low property tax burdens, which helps stretch a $100K salary much further.

Property taxes are tied directly to local home values, which means the burden can vary massively depending on where you live. A $100K salary in Texas, California, or Illinois can look very different once you factor in how much of your income goes to local governments.

Why Property Taxes Matter for Salaries

- Hidden cost of living: Even in states with no income tax (like Texas), property tax rates are among the highest in the country. This offsets some of the benefit of tax-free wages.

- Homeownership affordability: In high-cost cities, even a modest property tax rate can result in thousands of dollars in annual payments.

- Regional inequality: A household making $100K in Chicago or Austin may see 7–9% of their salary eaten by property taxes, while someone in Phoenix or Nashville only pays 2–3%.

Comparing the 30 Biggest Cities

To put numbers behind this, let’s assume a household earns $100,000 per year and owns a home at the local median home value. Here’s what portion of their salary would go toward property taxes:

- High Burden Cities: Austin, TX (8.6%), San Jose, CA (8.4%), Chicago, IL (7.4%), and San Francisco, CA (7.7%) stand out as some of the most expensive when measured against salary.

- Moderate Burden Cities: Places like New York (6.6%), Seattle (6.3%), and Dallas (6.1%) fall into the middle range — still significant, but not the worst.

- Low Burden Cities: Indianapolis (2.3%), Phoenix (2.4%), and Louisville (2.5%) show how much lighter the property tax hit can be in more affordable housing markets.

I’d love to see Miami, FL on these lists as examples. In Miami, some properties have a 2.2% on properties (or more) and “unincorporated” areas have 1.8% which make it extremely difficult to buy.