How Much You Need to Earn to Net $100K After Taxes in Every U.S. State

If you’ve landed a job making $100,000 or more, the reality is that money isn’t all yours for the keeping.

Federal income taxes, along with Social Security and Medicare contributions, already reduce your earnings. Add in state and local taxes, and even a six-figure salary can quickly dwindle to a five-figure take-home pay.

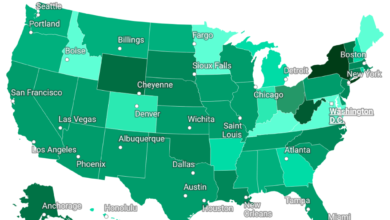

Researchers have calculated the exact salary you need to earn in each state to take home $100,000 annually after taxes.

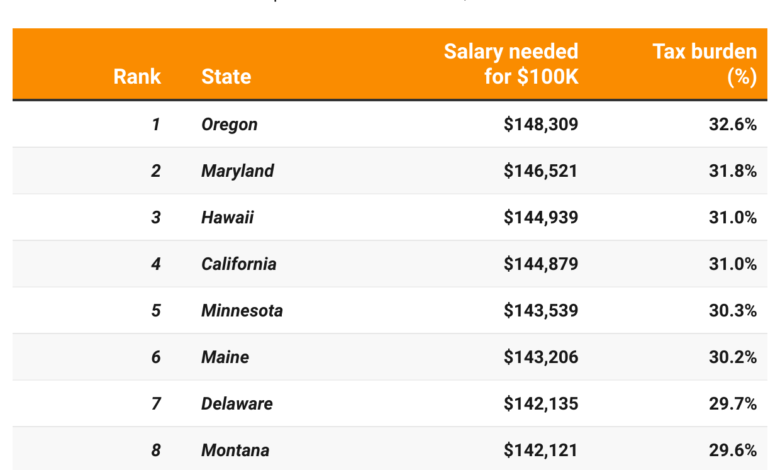

The five states where you need the highest salary to take home $100,000 after taxes are Oregon, Maryland, Hawaii, California, and Minnesota. To net that amount, your income must range from $143,539 in Minnesota to $148,309 in Oregon.

To take home $100,000, you’d need to earn $130,999 in each of the nine states that don’t impose a state income tax—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—making them tied for the lowest income required to net that amount.

Four states—Louisiana, Ohio, Arizona, and North Dakota—have income tax rates below 3%, placing them just above the states with no income tax.

Find out how much you actually need to earn in each state to take home a six-figure salary — ranked from highest to lowest.