Data VisualizationEconomyInvestingUS News

How Much You’d Earn If You Bought Property in 10 Major Cities 10 Years Ago

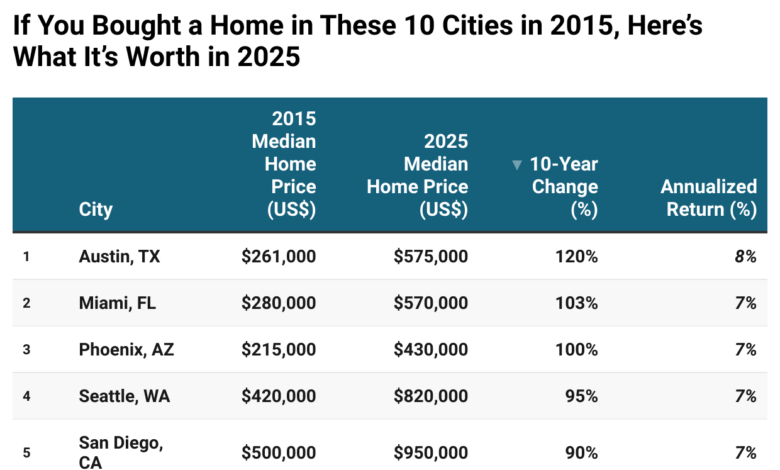

If you bought a home in 2015, you’d likely be sitting on serious gains today. Here’s how property values changed across major U.S. cities by 2025.

If you bought real estate in 2015, you’ve likely made more money than most investors realize. Over the past decade, U.S. home prices have surged, fueled by low interest rates, supply shortages, and a wave of migration during the pandemic.

While the stock market has been strong, many homeowners quietly doubled — or even tripled — their wealth through appreciation alone. Below is a breakdown of how much property values grew in 10 of America’s biggest metro areas between 2015 and 2025.

- Austin, TX was the standout performer of the decade — homes more than doubled in value, driven by tech expansion and migration from higher-cost states.

- Miami and Phoenix followed closely behind, benefiting from affordability, warm weather, and the remote-work migration boom.

- Seattle and San Diego remained coastal winners, both with ~7% annualized appreciation — far above inflation.

- New York and Chicago saw slower growth due to higher taxes and limited new population inflow.

- Even the “weakest” city in the list, Chicago, still produced about 4% annualized price growth — roughly matching long-term stock market returns after inflation.

Why Real Estate Outperformed?

- Historic Low Interest Rates (2015–2021) — Mortgage rates below 3% fueled record affordability.

- Post-COVID Migration — Millions moved from high-cost to mid-tier metros like Austin and Phoenix.

- Limited Supply — Decade-long underbuilding kept inventories tight, pushing prices upward.

- Inflation Hedge — Tangible assets like housing gained appeal as inflation rose post-2020.