Net Worth by Age in America (Average & Median) — 2025 Guide

How does your net worth compare to other Americans your age?

This is one of the most searched personal-finance questions on Google — and for good reason.

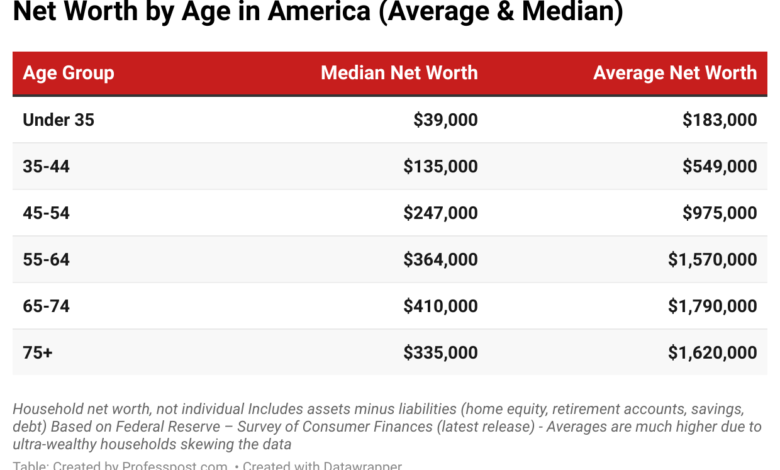

Below is the latest breakdown of U.S. household net worth by age, showing both the average and the median, using Federal Reserve data.

Average vs Median Net Worth: What’s the Difference?

Median net worth is the middle household — half have more, half have less. Average net worth is skewed higher by ultra-wealthy households.

👉 Most Americans should compare themselves to the median, not the average. This is why many people feel “behind” financially even when they’re doing fine.

What Is a “Good” Net Worth for Your Age?

Here’s a simple benchmark:

- Below median → Very common

- At median → Financially normal

- 2× median → Doing very well

- 5× median or more → Top-tier wealth for your age

Example: A 40-year-old household with $250,000 net worth is well above the median for ages 35–44.

Why Net Worth Grows With Age (Then Plateaus)

- 20s–30s: Student loans, low savings, early careers

- 40s–50s: Peak earnings + home equity growth

- 60s: Retirement accounts peak

- 70s+: Spending begins to exceed accumulation

This lifecycle pattern explains why net worth usually peaks around retirement age.

Is the Average American Really a Millionaire?

Technically, average net worth exceeds $1 million for older age groups — but this is misleading. Because wealth is highly concentrated:

- A small number of households hold enormous wealth

- The median American is far from a millionaire

This gap explains rising interest in wealth inequality and net worth comparisons.