Taxes

-

Finance

Net Worth by Age in America (Average & Median) — 2025 Guide

How does your net worth compare to other Americans your age? This is one of the most searched personal-finance questions…

-

Finance

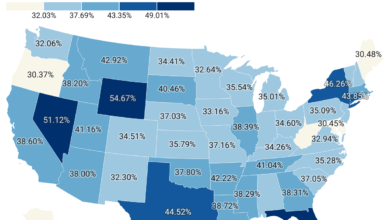

Top 1% Tax Contributions Across the U.S.: 2025 State Rankings

America’s top 1% pay 37% of all income taxes. This report highlights which states rely most—and least—on their tax contributions.…

-

Economy

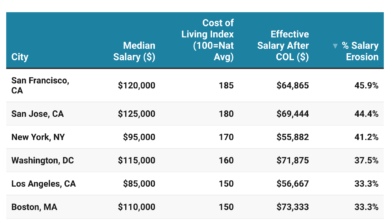

Which U.S. Cities Are Seeing the Fastest Salary Erosion from Rising Costs (2025 Data)

Key Findings: San Francisco and New York lead the list for salary erosion, where six-figure incomes shrink by 40–46% after…

-

Finance

Where Anesthesiologists Earn the Most: Gross Pay, Taxes, and Real Spending Power Across U.S. Cities

Anesthesiologist salaries vary widely across U.S. cities. This guide compares gross pay, after-tax income, and real spending power, revealing where…

-

Finance

How Much You Really Take Home: Median Salaries, After-Tax Income & Wage Loss Rates Across 30 Major U.S. Cities (2025)

Explore how median salaries, after-tax incomes, and wage loss rates vary across 30 major U.S. cities, revealing where your paycheck…

-

Finance

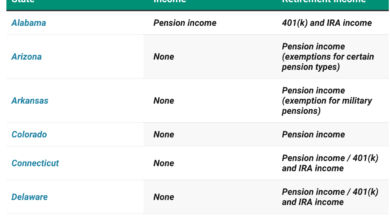

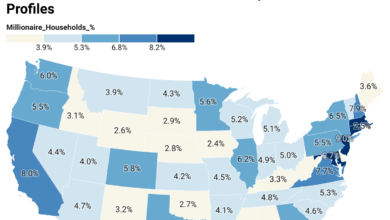

Which U.S. States Are Home to the Most Millionaires — and How Much They Pay in Taxes

Discover which U.S. states have the highest concentration of millionaires and explore their income, property, and sales taxes, revealing where…

-

Finance

Dentist Income and Real Spending Power in 30 Major U.S. Cities

Dentist salaries differ widely across U.S. cities. This analysis compares gross earnings, after-tax income, and real spending power, revealing where…

-

Finance

Where Realtors Earn the Most: Comparing Major U.S. Cities After Taxes and Living Costs

Realtors’ commissions vary widely across cities. This guide compares 30 major U.S. cities, showing gross earnings, after-tax income, and real…

-

Finance

How Much Median-Income Households Pay in Property Taxes Across America’s Biggest Cities

Property taxes can quietly eat into household budgets. Here’s how much of the median income goes to taxes in the…