Tax Loopholes the Wealthy Legally Use — And Why You Can’t

While most people scramble to maximize deductions, the ultra-wealthy play by a completely different set of tax rules — all perfectly legal. From offshore accounts to trust shelters, the tax code isn’t broken… it’s built this way.

The Game Is Rigged — But It’s Not Hidden

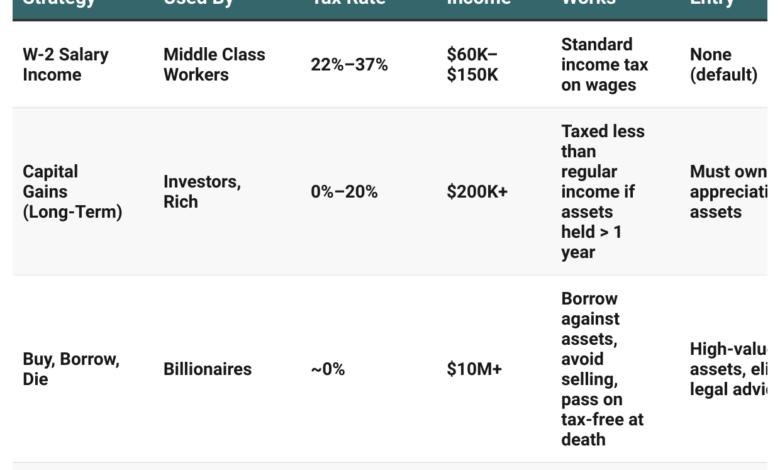

The U.S. tax system favors investors over workers. If you earn a salary, you’re likely paying a top marginal tax rate of 35%–37% on your income. But if you’re wealthy and your money comes from capital gains, real estate, or business equity, your effective tax rate might be 15% or less. The system rewards ownership, not labor. That’s the core difference — and the beginning of most legal loopholes the rich use.

1. The “Buy, Borrow, Die” Strategy

One of the most powerful tax strategies the wealthy use is often described as “buy, borrow, die.” Wealthy individuals buy appreciating assets — such as stocks or real estate — and hold them long-term. Instead of selling these assets and triggering capital gains taxes, they borrow against them using the assets as collateral. These loans are tax-free because they’re not considered income.

When they die, their heirs inherit the assets with a stepped-up cost basis, meaning any gains during their lifetime are erased for tax purposes. It’s a legal method of transferring millions — sometimes billions — tax-free.

2. Real Estate Depreciation and the 1031 Exchange

Real estate investors get to deduct depreciation, even if the value of the property goes up. This allows them to claim paper losses while still collecting rental income. In many cases, investors pay little or no tax on profitable properties.

The 1031 Exchange lets them sell one property and roll the profits into another without paying capital gains taxes — deferring them indefinitely, or avoiding them entirely if passed to heirs.

3. Private Foundations and Donor-Advised Funds

By donating appreciated assets to a private foundation or a donor-advised fund, the wealthy receive immediate tax deductions. At the same time, they often maintain control over how the money is invested or distributed, and can even pay family members through foundation roles.

It’s philanthropy with perks — a strategic way to minimize taxes while building legacy influence.

4. Offshore Accounts and Corporate Structures

Many high-net-worth individuals and multinational corporations use offshore accounts and shell companies to avoid U.S. taxes. By shifting profits to low-tax jurisdictions, they reduce their tax burden significantly — legally.

Apple once legally parked over $250 billion offshore to avoid repatriation taxes. It’s a practice most small businesses can’t replicate due to legal and logistical hurdles.

5. Carried Interest — The Billionaire Bonus

Private equity and hedge fund managers benefit from the carried interest loophole, which allows them to pay capital gains tax (20%) on income that would otherwise be taxed at 37%. This loophole remains protected despite bipartisan criticism, due to its enormous financial benefits for the elite.

So Why Can’t You Use These Loopholes?

Most of these strategies require scale, capital, and elite legal or tax expertise. While the average person can’t afford to set up offshore trusts or real estate LLCs, the ultra-wealthy pay teams of lawyers and accountants to build these structures.

The tax code isn’t secret — but exploiting it effectively requires money and knowledge most people don’t have access to.

Final Thoughts: Learn the Rules, Then Play the Game

These loopholes aren’t reserved for the ultra-rich because they’re hidden — they’re reserved because they’re complex and expensive. But that doesn’t mean they’re completely off-limits. Learning how the wealthy reduce taxes can be the first step toward building long-term wealth.

Start by investing in appreciating assets, creating small business entities, and taking control of your financial education. Because in America, the rich don’t cheat the system — they learn to master it.

This article is misleading at best. You are conflating earned income with capital gains. Middle income people earn capital gains every day and pay the same rate as others. Yes, the other items are used by people that have wealth, but it’s not exclusive to them. It’s funny how we seem to think it’s ok we are taxed on money we make(salary), taxed when we earn interest on our savings, taxed when we spend our money, taxed when we sell an asset and taxed on assets(houses for example). How about we spend less and everyone gets to keep more of what they earn.