Top 1% Tax Contributions Across the U.S.: 2025 State Rankings

America’s top 1% pay 37% of all income taxes. This report highlights which states rely most—and least—on their tax contributions.

The top 1% of earners take in about 19.5% of all income in the U.S.—a fact that often draws criticism from politicians and commentators. Yet this group also pays roughly 37% of the nation’s total income taxes, providing a substantial share of the funding that supports infrastructure, healthcare, welfare programs, and other public services. While wealthier households may have access to tax planning strategies or may relocate to more tax-friendly states, their contributions still make up a significant portion of state and federal revenue. Proposals to increase taxes on high-income earners could boost government revenue, but they also risk pushing this tax base—and its associated local spending—elsewhere.

With this context, SmartAsset analyzed the latest IRS data to identify where the top 1% contribute the most and least in taxes. The study also examines how much income this group earns in each state and their average adjusted gross income (AGI).

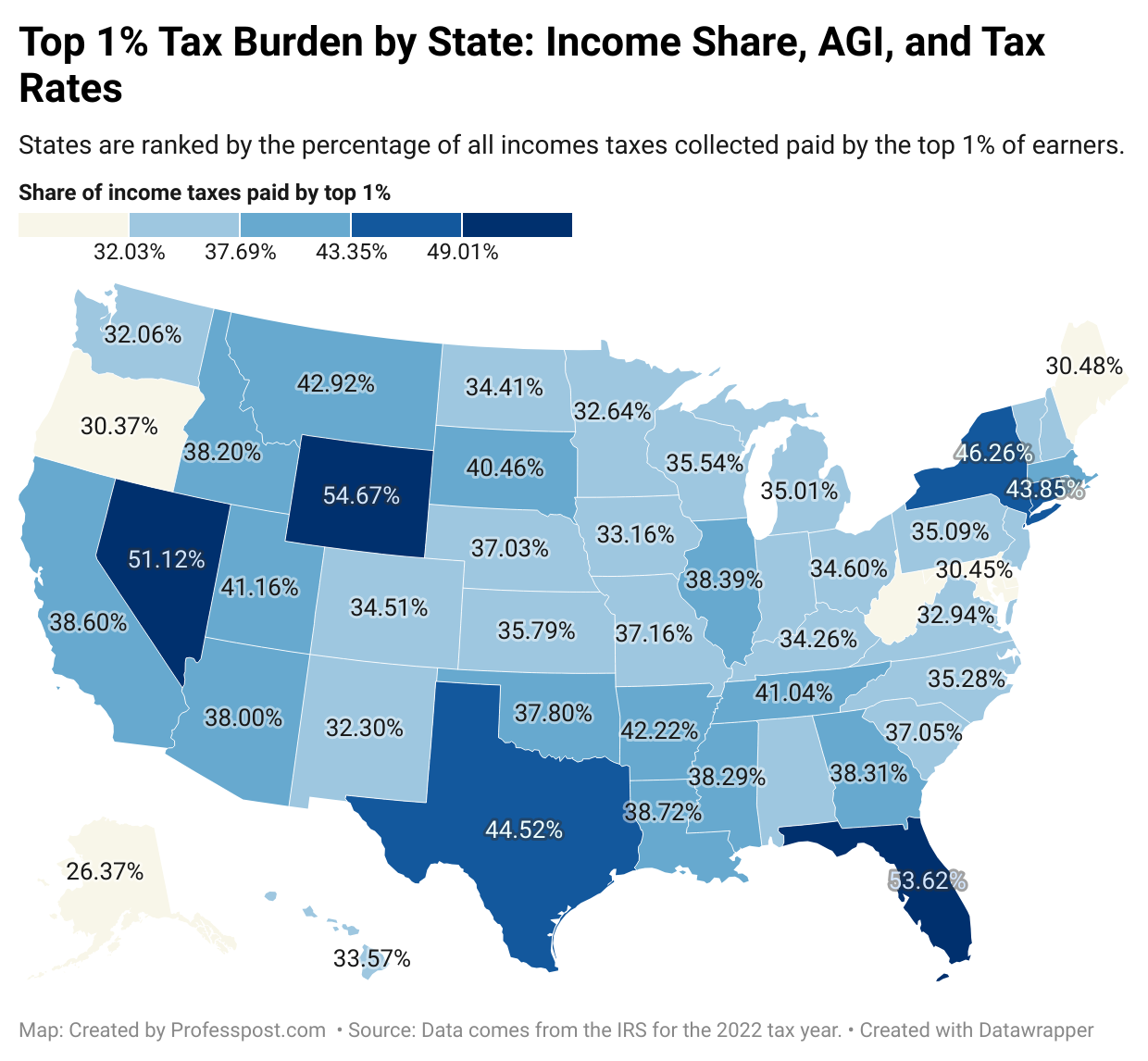

- In three states, the top 1% of earners provide more than half of all income tax revenue. Wyoming leads the nation, with just 2,611 top-earning households supplying 54.7% of the state’s total income tax collections. Florida ranks second, where 105,101 top-income households contribute 53.6% of all income tax revenue. Nevada follows in third place, with its 14,754 highest-earning households accounting for 51.1% of the state’s income tax total.

- In New York, the top 1% of earners provide 46.2% of the state’s total income tax revenue, placing New York fourth nationwide for highest top-1% tax contributions. Among the 91,840 households in this bracket, the average AGI is $3.13 million. Altogether, these high-income earners pay approximately $79.5 billion in state income taxes each year.

- California’s top 1% contribute more than $122 billion in income taxes each year—the largest total of any state. The 175,045 households in this bracket earn an average AGI of $2.60 million and account for 38.6% of all state income tax revenue. Despite the massive dollar amount collected, California ranks 13th nationwide in the share of taxes paid by its top 1%.

- Connecticut’s highest earners face the steepest effective tax rates in the nation. The state’s top 1% pays an average rate of 28.09% on a typical household AGI of $3.43 million, generating just over $16 billion in revenue—about 43.85% of all income taxes collected statewide. By contrast, Wyoming’s top 1% pays the lowest effective rate at 23.1%.