What It Takes to Reach the Top 10% of Household Net Worth in Dallas

In Dallas, joining the top 10% is less about earning a headline salary and more about:

- Owning appreciating assets

- Keeping leverage manageable

- Allowing time to work in your favor

- Income opens the door, but assets determine where you land.

Dallas is often described as an “affordable” big city, especially compared with coastal metros. But affordability doesn’t mean wealth is evenly distributed. When you look at household net worth rather than income, the gap between the average household and the top 10% in Dallas is wider than many residents assume.

This article looks at what it realistically takes to land in the top 10% of households by net worth across the Dallas–Fort Worth area, using asset-based estimates rather than salary figures.

Why Net Worth Tells a Different Story in Dallas

Dallas creates wealth differently from tech-heavy cities. High incomes matter, but the dominant drivers of wealth here tend to be:

- Long-term homeownership

- Business ownership and private equity

- Multiple income streams rather than stock compensation

As a result, households that appear “middle class” based on spending or lifestyle may rank surprisingly high once assets and liabilities are considered.

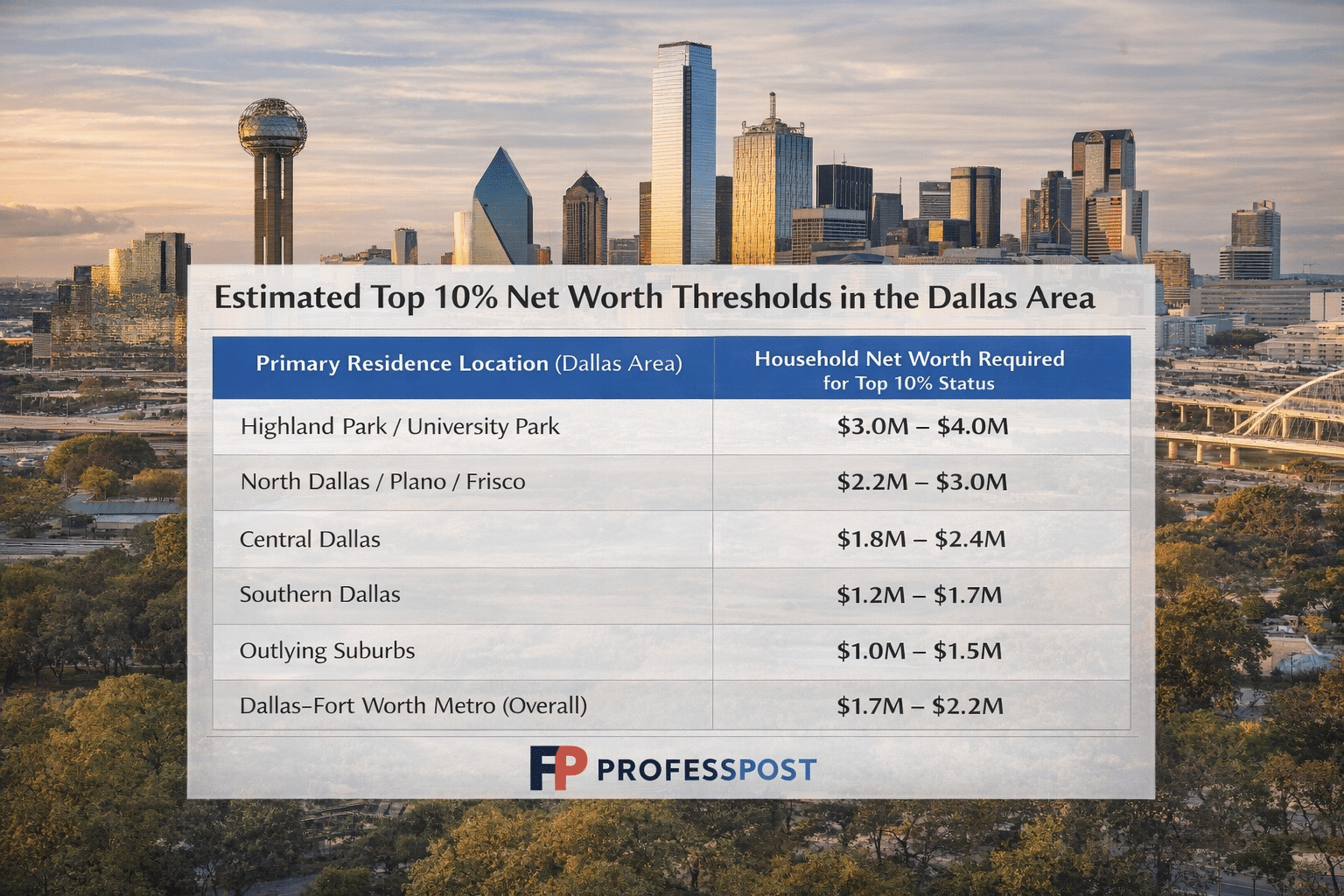

Estimated Top 10% Net Worth Thresholds in the Dallas Area

Based on housing values, ownership rates, and regional asset concentration, the following ranges represent where the top decile of household net worth begins in different parts of the Dallas metro.

What Pushes the Dallas Threshold Higher Than Expected

Despite lower housing costs than coastal cities, Dallas’s top 10% cutoff is lifted by several structural factors:

- Real Estate Scale: Large homes on valuable land parcels create significant equity, especially for households that bought before the most recent growth cycle.

- Privately Held Businesses: Dallas has a high share of owner-operated businesses, professional practices, and real estate partnerships that don’t show up clearly in income data but materially increase net worth.

- Debt Structure: Lower state taxes and cheaper credit often allow households to accumulate assets faster, even when carrying substantial leverage.

What Being “Top 10%” Actually Looks Like in Dallas

Reaching the top 10% does not necessarily mean a luxury lifestyle or financial independence. Many households at this level are: Heavily invested in real estate, Dependent on business cash flow and Sensitive to property cycles and interest rates. In Dallas, wealth accumulation is often steady and compounding — but less liquid than it appears.

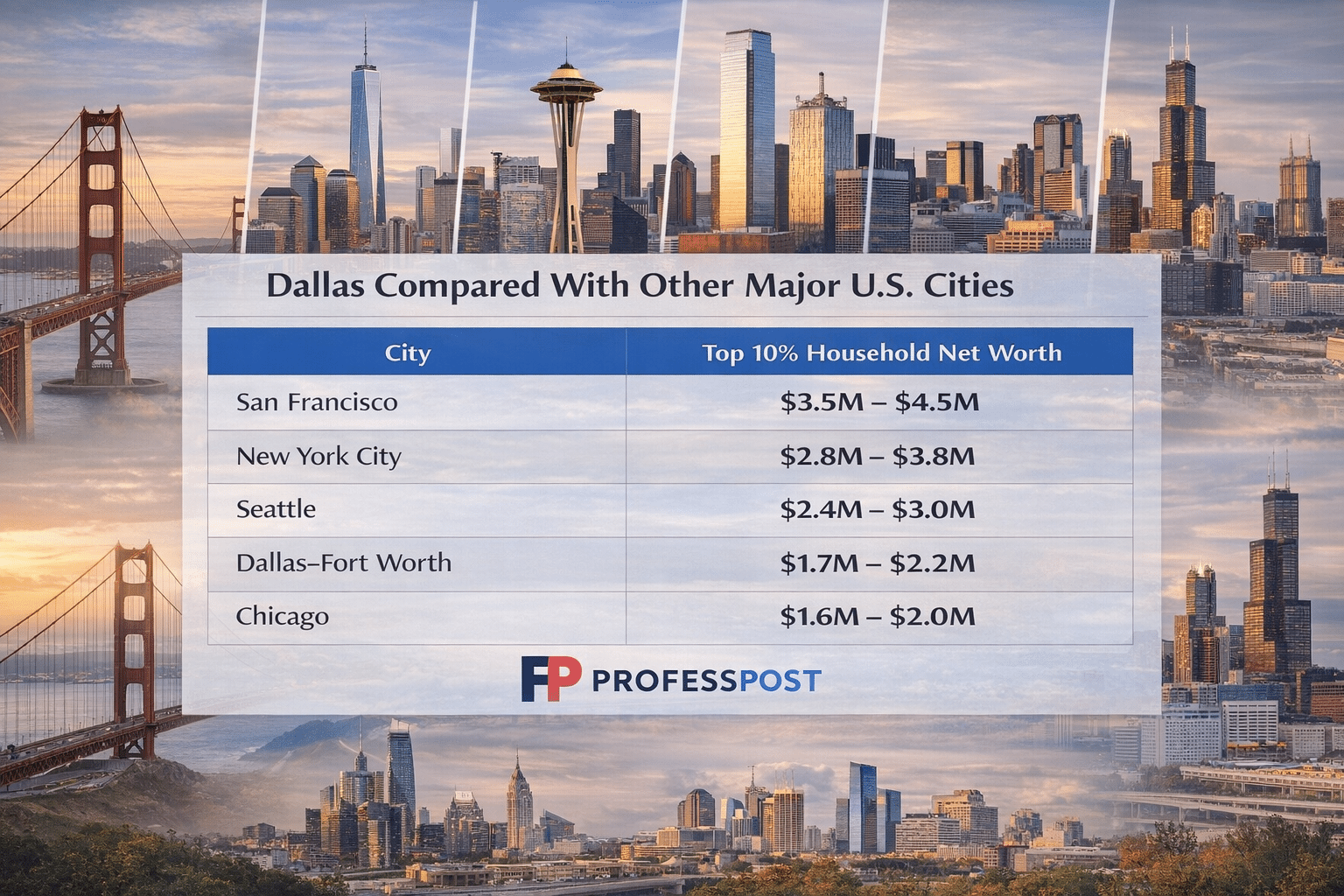

Dallas Compared With Other Major U.S. Cities

On a national scale, Dallas sits between high-cost coastal metros and older Midwest cities.