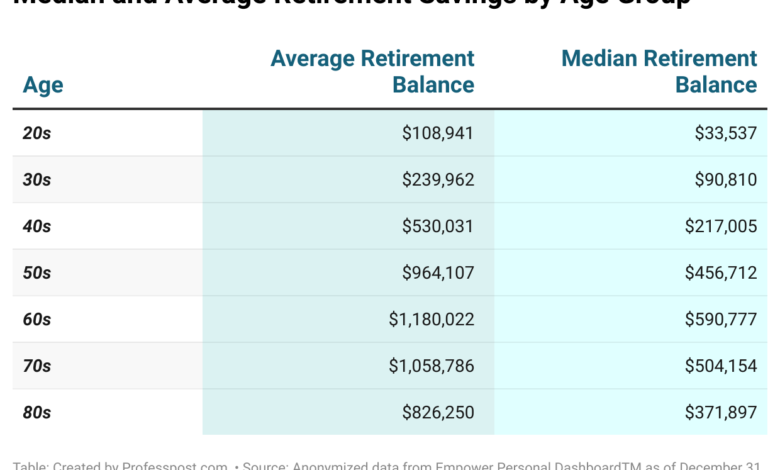

Average and Median Retirement Savings by Age Group in the U.S.

Based on data from Empower Personal Dashboard™, the average American has $492,795 saved for retirement. Here’s a breakdown of average retirement savings by age group.

The average American has approximately $492,795 saved for retirement. Individuals in their 60s hold the highest retirement savings, with average balances nearing $1.2 million. Retirement account balances more than double from the 20s to the 30s, reflecting a significant increase in savings as people progress through their careers. Even in their 80s, Americans maintain an average retirement balance of $826,250.

There are several ways to save for retirement, including contributing to an employer-sponsored plan, opening an individual retirement account (IRA), or investing through a brokerage account.

According to research by Empower, 70% of Americans contribute to a retirement plan. However, participation varies by generation: only 47% of Gen Z report saving in a plan like a 401(k) or 403(b), compared to 75% of Millennials and 76% of Gen Xers.

The average retirement savings balance is $492,795, though this amount varies significantly by generation. Individuals aged 60 and older hold the highest total balances across their retirement accounts.

Take a look at the chart below for a breakdown of total retirement savings by age group.

Retirement Savings by Age

In Your 20s

Americans in their 20s have an average retirement savings of $108,941, while the median balance is $33,537. Your 20s are a prime time to start saving for retirement, thanks to the power of compound interest. Even small contributions now can grow significantly over time.

In Your 30s

By their 30s, Americans have an average retirement savings of $239,962 and a median of $90,810. This decade is ideal for building both retirement and emergency savings. However, many Millennials—60%, according to Empower—worry about unexpected expenses and often have just $500 set aside for emergencies.

In Your 40s

Americans in their 40s average $530,031 in retirement savings, with a median of $217,005. With increasing income potential, this is a good time to boost retirement contributions. You can work toward maximizing your contributions—up to $23,000 for employer-sponsored plans and $7,000 for IRAs in 2024.

In Your 50s

The average retirement savings for people in their 50s is $964,107, with a median of $456,712. As retirement approaches, saving should become a key focus.

In Your 70s

Americans in their 70s have an average retirement savings of $1,058,786, with a median of $504,154—putting many in the millionaire bracket. Most people retire in their mid-60s, but rising healthcare costs can impact savings. Empower research shows 58% of Americans are open to working indefinitely, driven by financial needs (41%) and personal fulfillment (40%).