Car Insurance in Florida : Real Costs by City + ZIP Code Calculator

Car Insurance in Florida (2026): Real Costs by City + ZIP Code Calculator

Trying to price out car insurance in Florida? You’re not alone. Florida is consistently one of the most expensive states for auto coverage, and the number you pay can change dramatically depending on where you live — sometimes within the same metro area.

This guide gives you: (1) a Florida city-by-city price table, (2) a plain-English breakdown of what drives rates up or down, and (3) an interactive ZIP-based estimator you can use right on this page.

Florida car insurance at a glance

- Florida average (baseline driver): NerdWallet’s January 2026 rate analysis estimates $3,731/year for full coverage and $1,103/year for minimum coverage for a 35-year-old driver with good credit and a clean record. (Source)

- Florida minimum insurance requirement: Florida generally requires at least $10,000 PIP and $10,000 PDL to register a vehicle. (FLHSMV)

- ZIP codes matter: Your premium can change based on location “right down to your ZIP code.” (The Zebra)

Important: This page provides estimates and educational guidance — not insurance quotes. Final pricing depends on your insurer, driving history, vehicle, coverage limits, deductible, credit tier (where permitted), and more.

Why Florida car insurance is so expensive

Florida rates tend to run high for a few recurring reasons:

- No-fault rules (PIP): Florida is a no-fault state and requires PIP coverage for most registered vehicles. (FLHSMV)

- Claim frequency + severity: Dense traffic, accident frequency, and higher repair/medical costs can push premiums up.

- Uninsured / underinsured exposure: If more drivers in an area carry minimal coverage, insurers may price in extra risk.

- Regional volatility: Some metro areas have more variability due to claim patterns and market conditions (which is why “ZIP differences” are real).

If you want the shortest practical takeaway: Florida insurance is expensive, and your location is one of the biggest levers — especially in major metros.

What car insurance is required in Florida?

For most vehicles, Florida requires:

- $10,000 Personal Injury Protection (PIP)

- $10,000 Property Damage Liability (PDL)

That’s the baseline to register a vehicle in many cases. For special vehicle use cases (like taxis), rules can differ — so always verify on the official page: Florida Highway Safety and Motor Vehicles (FLHSMV).

Real-world tip: “Minimum required” can be legally sufficient but still financially risky after a serious crash. Many Florida drivers carry higher liability limits and add comprehensive/collision if they want “full coverage.”

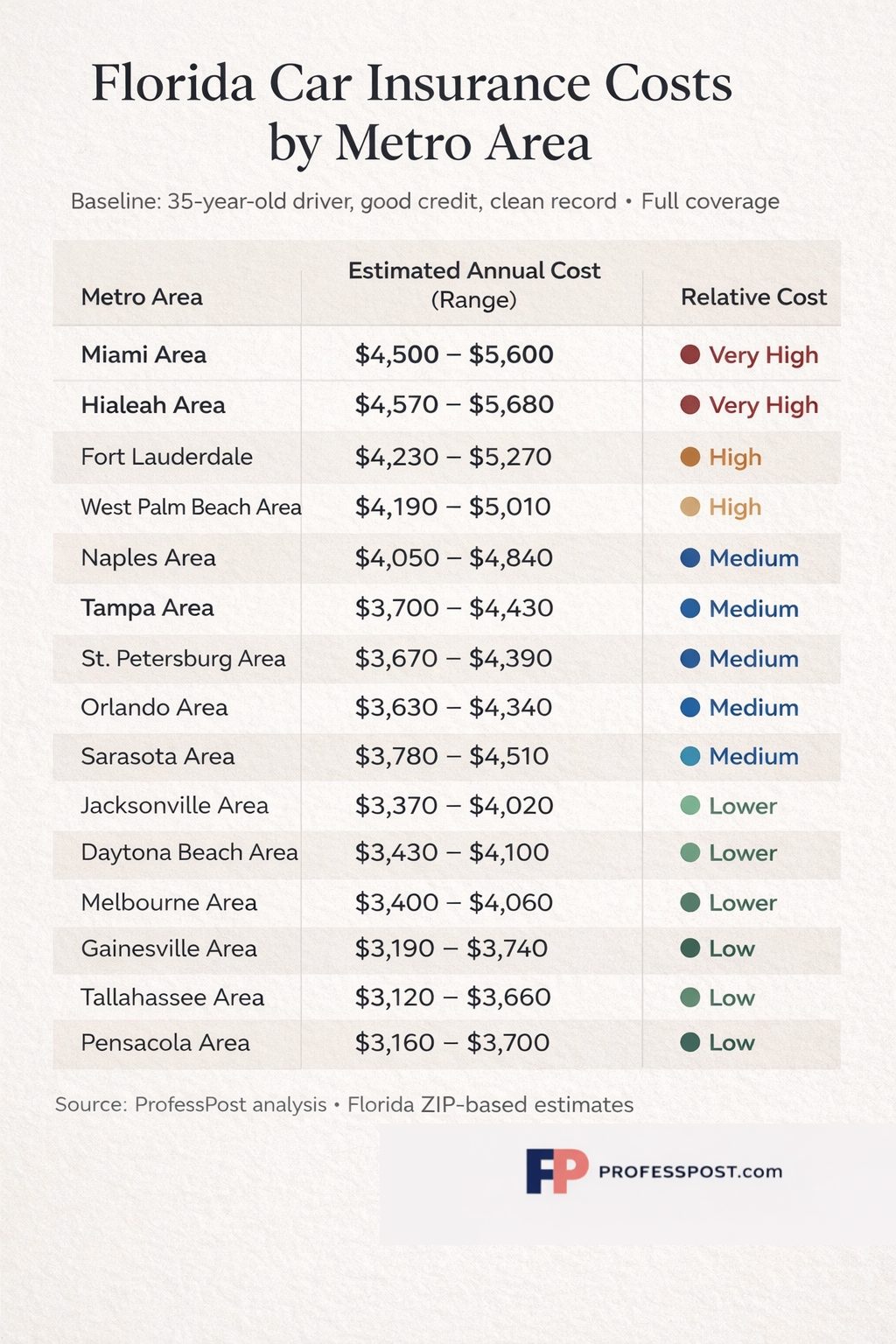

Florida city-by-city price table (estimated annual cost)

This table uses a single baseline profile (35-year-old, good credit, clean record) and applies realistic regional multipliers to show an estimated annual range for full coverage. The goal is to help you compare places quickly — not replace shopping quotes.

| Florida city / area | Estimated full coverage (low) | Estimated full coverage (high) | Approx. midpoint |

|---|---|---|---|

| Miami Area | $4,500 | $5,599 | $5,000 |

| Hialeah Area | $4,567 | $5,683 | $5,074 |

| Fort Lauderdale Area | $4,231 | $5,265 | $4,701 |

| West Palm Beach Area | $4,188 | $5,007 | $4,552 |

| Boca Raton Area | $4,050 | $4,843 | $4,403 |

| Hollywood Area | $4,117 | $4,923 | $4,477 |

| Orlando Area | $3,635 | $4,344 | $3,955 |

| Kissimmee Area | $3,635 | $4,344 | $3,955 |

| Deltona Area | $3,482 | $4,163 | $3,768 |

| Tampa Area | $3,705 | $4,428 | $4,030 |

| St. Petersburg Area | $3,671 | $4,386 | $3,992 |

| Clearwater Area | $3,635 | $4,344 | $3,955 |

| Lakeland Area | $3,568 | $4,264 | $3,880 |

| Sarasota Area | $3,776 | $4,513 | $4,104 |

| Bradenton Area | $3,741 | $4,472 | $4,067 |

| Jacksonville Area | $3,366 | $4,022 | $3,656 |

| Daytona Beach Area | $3,431 | $4,100 | $3,731 |

| Melbourne Area | $3,396 | $4,058 | $3,694 |

| Palm Bay Area | $3,396 | $4,058 | $3,694 |

| Port St. Lucie Area | $3,602 | $4,306 | $3,918 |

| Tallahassee Area | $3,122 | $3,657 | $3,358 |

| Gainesville Area | $3,188 | $3,738 | $3,433 |

| Pensacola Area | $3,155 | $3,700 | $3,395 |

| Panama City Area | $3,222 | $3,779 | $3,470 |

| Cape Coral Area | $3,931 | $4,699 | $4,291 |

| Fort Myers Area | $3,896 | $4,657 | $4,254 |

| Naples Area | $4,050 | $4,843 | $4,403 |

| Ocala Area | $3,431 | $4,100 | $3,731 |

How to read this table: It’s a fast comparison tool. Your real quote may be higher or lower based on your vehicle, coverage limits, deductibles, and personal rating factors.

Interactive Florida car insurance calculator (ZIP-based)

Use the calculator below to estimate your annual cost range by ZIP code. This uses a single baseline profile and adjusts by local pricing differences — not a quote.

Calculator:

Florida Car Insurance Estimate by ZIP

Updated to better match what households actually pay. Default settings reflect a typical discounted household. Adjust options under “Match your situation.”

How to lower your car insurance in Florida

- Shop rates at least once a year: Florida pricing changes fast; a new carrier can make a big difference.

- Increase your deductible (if you can cover it): Higher deductibles often reduce premiums.

- Ask about discounts: Multi-policy, safe driver, paid-in-full, defensive driving, and vehicle safety features.

- Right-size coverage: Don’t over-insure an older vehicle, but don’t under-insure your liability if you have assets.

- Consider uninsured/underinsured coverage: Many drivers choose this in Florida due to risk exposure.

FAQ

Does ZIP code really affect car insurance in Florida?

Yes. Insurers price location risk down to the ZIP level because accident frequency, theft, vandalism, repair costs, and claim patterns vary locally. (The Zebra)

Is this a real insurance quote?

No. This page provides estimates and ranges for education and comparison. For a binding quote, you’ll need to apply with an insurer.

What is the minimum required car insurance in Florida?

Florida generally requires at least $10,000 PIP and $10,000 PDL to register a vehicle. (FLHSMV)

Methodology & data notes

- Baseline driver profile: 35-year-old with good credit and a clean driving history (matching NerdWallet’s Florida baseline in its January 2026 analysis). (NerdWallet)

- Florida averages: Used as a baseline anchor for full/minimum coverage estimates, then adjusted by local multipliers to reflect regional pricing differences.

- Estimates vs. quotes: Outputs are ranges and not binding quotes. Pricing varies by insurer, vehicle, coverage limits, deductible, and personal factors.

Want to cite additional public benchmarks? Bankrate also publishes Florida average premium estimates (methodologies differ by publisher). (Bankrate)