How Far a $100K Salary Really Goes in Every U.S. State (After Taxes & Cost of Living, 2025)

In high-tax, high-cost states, six figures may feel stretched thin, while in more affordable states, it can feel like a truly upper-middle-class income. To get a clear picture, we ranked all 50 states by how much a $100K salary is worth after 2025 federal taxes, state/local tax burdens, and cost-of-living adjustments.

The result is a state-by-state breakdown showing where $100,000 gives you the most effective spending power—and where it leaves you feeling closer to middle-class than wealthy. This ranking helps job seekers, remote workers, and anyone considering a move understand how far their salary really goes across America.

Top Takeaways

- Mississippi, West Virginia, and Arkansas are the top states where $100K stretches the furthest, thanks to low costs and moderate tax burdens.

- Hawaii, California, and New York are where $100K feels the smallest, largely because of sky-high housing costs and higher state/local taxes.

- Some states with no income tax—like Texas and Florida—still rank mid-pack, because cost-of-living pressures reduce the advantage.

- Cost of living (RPP index) is just as important as taxes—sometimes even more—in determining how far a salary goes.

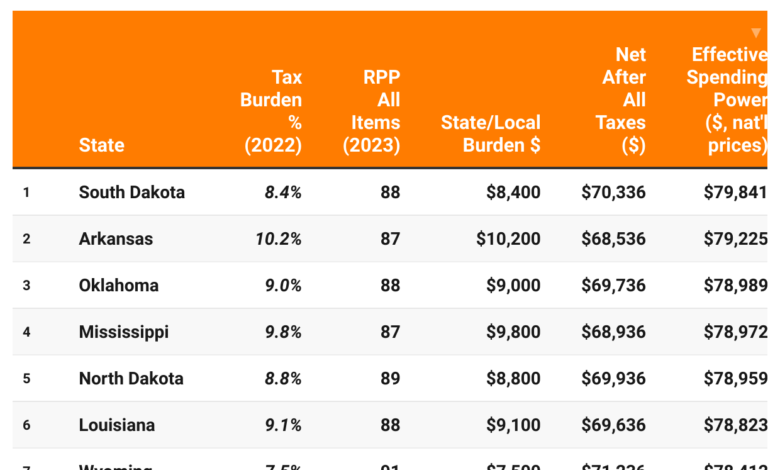

Ranked Table: $100K Salary Value in Every U.S. State (2025)

The table below shows the real value of a $100,000 salary after accounting for federal taxes, state/local tax burdens, and the cost of living (RPP index). A higher “Effective Spending Power” means your $100K goes further in that state.

Why Some States Stretch $100K Further

States in the South and Midwest consistently appear at the top of the ranking because they combine relatively low state/local tax burdens with a cost of living well below the national average. A $100K salary in Mississippi or Arkansas buys significantly more housing, groceries, and services than the same salary in New York or California.

By contrast, coastal states—especially Hawaii, California, New York, and Massachusetts—eat away at income through a combination of high state/local taxes and steep costs for housing, energy, and everyday essentials. In these states, $100K may barely cover the basics of a middle-class lifestyle.

Methodology

This ranking uses three key data points:

- Federal Taxes (2025): Based on IRS tax brackets for single filers with the standard deduction. Includes both income tax and FICA payroll taxes, totaling about $21,264 on $100,000 of income.

- State & Local Tax Burden: From the Tax Foundation’s 2022 State-Local Tax Burden data, which estimates the average combined share of income residents pay in state and local taxes.

- Cost of Living (RPP Index): From the Bureau of Economic Analysis (BEA) Regional Price Parities, 2023, which measures price level differences across states.

We subtracted federal and state/local taxes from the $100K gross salary to calculate “Net After Taxes.” That figure was then adjusted using each state’s RPP to produce the “Effective Spending Power” — the true national-dollar equivalent of $100K in each location.

Conclusion

For many Americans, $100,000 still represents a strong income — but its real-world value depends heavily on where you live. Someone earning six figures in Mississippi may enjoy the purchasing power of nearly $80K in national dollars, while the same salary in Hawaii is worth closer to $53K. For job hunters and remote workers, understanding this variation can be the key to maximizing both income and quality of life.