How Much Net Worth You Need to Be in Columbus’s Top 10% — By Area (2025)

Columbus, Ohio doesn’t usually dominate national wealth rankings — and that’s exactly what makes it compelling. Without the extreme housing costs or ultra-high incomes of coastal metros, Columbus offers something many households value more: a realistic path to long-term financial security.

Rather than focusing on income, this analysis looks at household net worth — what you own minus what you owe — and breaks down how much wealth it takes to reach the top 10% of households across different areas of the Columbus metro in 2025.

Why Net Worth Matters More Than Income

Income reflects annual earnings. Net worth reflects years of financial decisions.

Household net worth includes:

- Home equity

- Retirement accounts (401(k), IRA)

- Investment and brokerage accounts

- Cash and business assets

And subtracts:

- Mortgages

- Student loans

- Consumer and personal debt

In a city like Columbus — where housing remains relatively affordable — net worth often paints a far clearer picture of financial stability than salary alone.

Columbus-Wide Top 10% Net Worth Benchmark

Across the entire Columbus metro area, the estimated household net worth required to reach the top 10% in 2025 is:

$900,000 – $1.3 million

This figure is significantly lower than in major coastal cities, yet still represents strong financial footing when adjusted for Columbus’s cost of living.

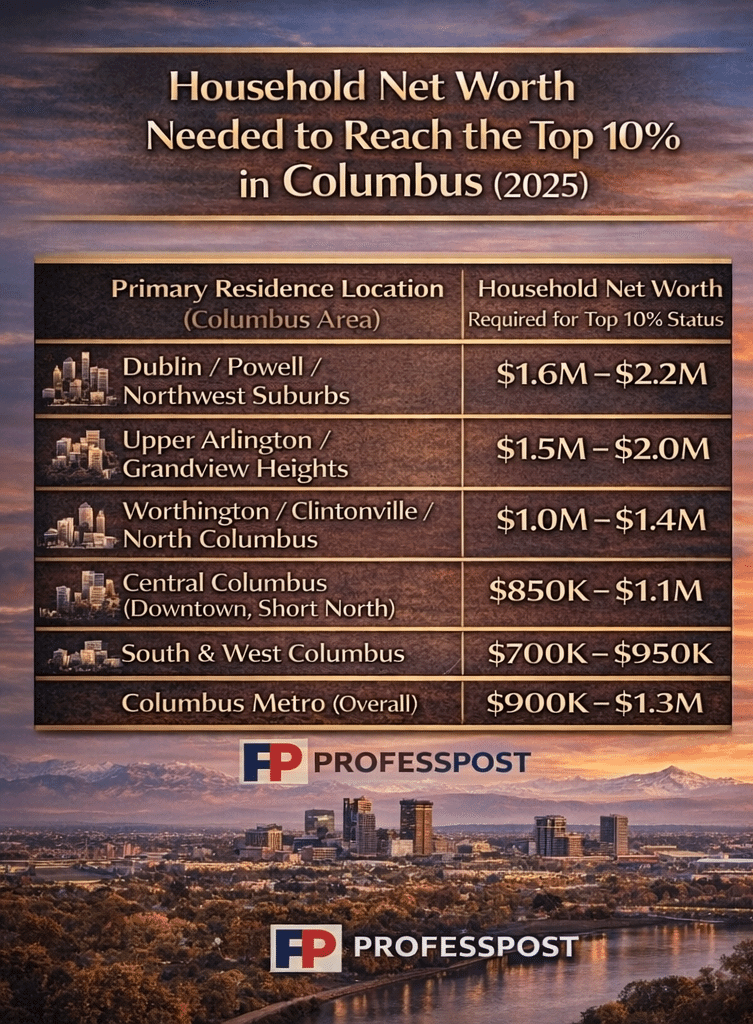

Household Net Worth Needed to Reach the Top 10% in Columbus — By Area

Dublin, Powell & Northwest Suburbs

Top 10% Net Worth: $1.6M – $2.2M

These suburbs contain the highest concentration of wealth in the Columbus metro. Top households here typically combine high incomes, long-term home appreciation, and substantial retirement and investment portfolios. Simply owning a home is not enough — most top-decile households hold seven figures in total assets.

Upper Arlington & Grandview Heights

Top 10% Net Worth: $1.5M – $2.0M

Wealth in these neighborhoods is driven by stability. Many households purchased homes decades ago, accumulated significant equity, and consistently invested in retirement accounts. Time in the market matters more here than sudden income spikes.

Worthington, Clintonville & North Columbus

Top 10% Net Worth: $1.0M – $1.4M

This area reflects Columbus’s version of “quiet wealth.” Households often carry little debt, have paid down mortgages, and rely on steady retirement savings rather than speculative investments to reach the top decile.

Central Columbus (Downtown & Short North)

Top 10% Net Worth: $850K – $1.1M

Central Columbus skews younger and more transient. Top households here are more likely to build wealth through income and investments rather than home equity, resulting in a lower top-10% threshold despite rising property values.

South & West Columbus

Top 10% Net Worth: $700K – $950K

In these areas, low debt plays a major role. Many top-decile households own homes outright or maintain minimal liabilities. Modest incomes paired with financial discipline can still place households among Columbus’s wealthiest.

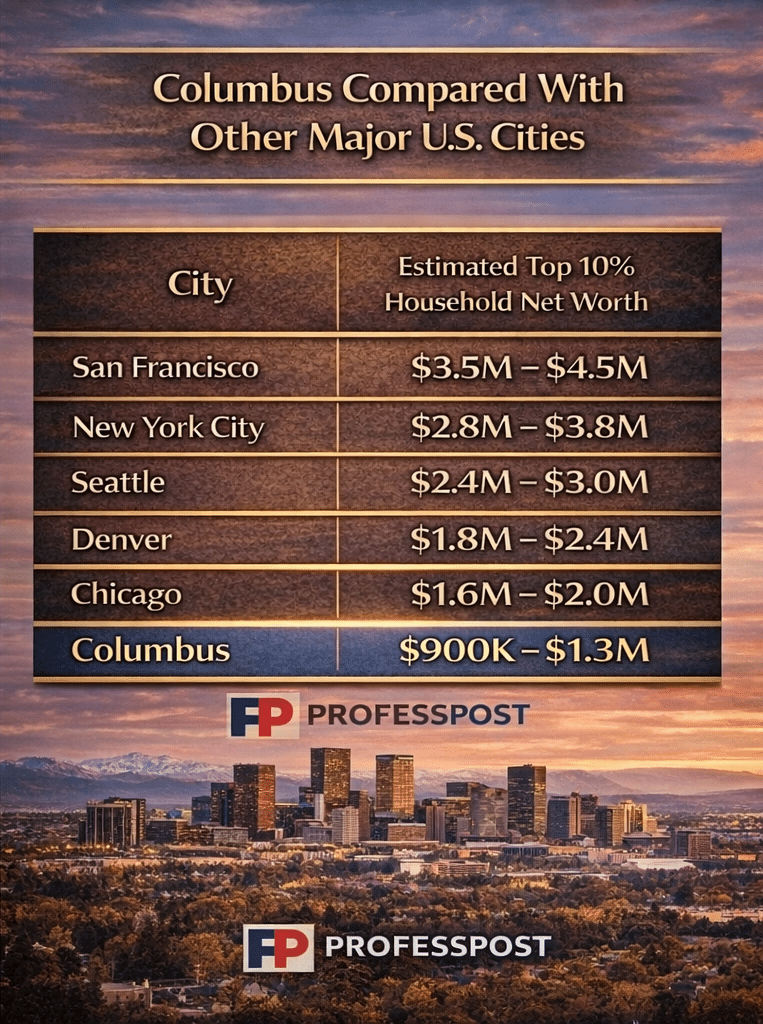

Columbus Compared With Other Major U.S. Cities

When compared with other large U.S. metros, Columbus stands out for how attainable top-decile wealth is:

- San Francisco: $3.5M – $4.5M

- New York City: $2.8M – $3.8M

- Seattle: $2.4M – $3.0M

- Denver: $1.8M – $2.4M

- Chicago: $1.6M – $2.0M

- Columbus: $900K – $1.3M

In practice, a $1 million net worth in Columbus often supports a lifestyle comparable to $2 million or more in higher-cost cities.

What Being in the Top 10% Looks Like in Columbus

In Columbus, top-decile wealth usually means:

- A paid-down or manageable mortgage

- Strong retirement savings

- Low consumer debt

- Financial resilience during economic downturns

It rarely means luxury lifestyles or extreme spending. Instead, wealth in Columbus is often understated — and durable.

Related Wealth Benchmarks in Other Major U.S. Cities

If you’re curious how Columbus compares with other major metros, you may also find these detailed breakdowns useful:

How Much Net Worth Puts You in Denver’s Top 10% (2025)

How Much Net Worth You Need to Be in Chicago’s Top 10% — By Area

What It Takes to Be in the Top 10% of Household Wealth in Washington, D.C.

Sources & Methodology

This analysis estimates the household net worth required to reach the top 10% in Columbus, Ohio by combining national wealth distribution data with local housing, income, and cost-of-living metrics.

Because detailed, city-level net worth percentiles are not published annually for most U.S. metros, the figures presented here are modeled estimates rather than exact thresholds.

Primary Data Sources

- Federal Reserve – Survey of Consumer Finances (SCF)

- U.S. Census Bureau – American Community Survey (ACS)

- Federal Reserve Bank of St. Louis (FRED)

- Bureau of Economic Analysis (BEA)

- Local housing market data and historical home price trends

Methodology Overview

The process used to estimate top-decile net worth thresholds includes:

- Starting with national net worth percentiles from the Federal Reserve’s Survey of Consumer Finances

- Adjusting those benchmarks based on Columbus-area income levels and cost-of-living differences relative to the U.S. average

- Incorporating regional housing values and long-term homeownership patterns by area

- Cross-referencing results with comparable metropolitan areas for consistency

Household net worth includes primary residence equity, retirement accounts, investment assets, business ownership, and cash, minus outstanding debts such as mortgages, student loans, and consumer credit.

All figures are expressed in 2025 dollars and represent approximate ranges rather than precise cutoffs. Individual household circumstances can vary significantly based on age, debt structure, and asset composition.

This methodology is designed to provide realistic, location-specific context — not financial advice — and to help readers better understand how wealth levels differ across U.S. cities and neighborhoods.