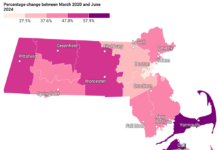

Massachusetts State Median Property Tax Rate and Median Home Value for 2024 by County

Massachusetts has some of the highest average property tax rates in the nation, with only five states imposing higher taxes on property.

The median property tax in Massachusetts is $3,511 per year for a home valued at the state’s median price of $338,500. On average, counties in Massachusetts levy a property tax rate of 1.04% of a property’s assessed fair market value annually.

With a median household income of $83,915 per year, the median property tax in Massachusetts represents approximately 1.04% of the average yearly income. The state ranks 9th among the 50 states in terms of property taxes as a percentage of median income.

The actual property tax rate can vary depending on the county. Middlesex County has the highest property tax in the state, collecting an average of $4,356 annually (1.04% of the median home value), while Berkshire County has the lowest, with an average property tax of $2,386 per year (1.15% of the median home value).

The interactive map below shows Median Property Tax Rate and Median Home Value for 2024 by County