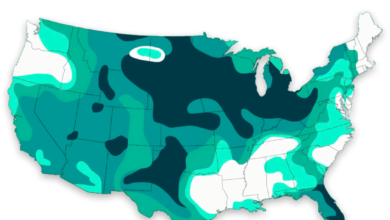

Washington State Property Tax Rate 2024 by County

Washington has one of the highest average property tax rates in the country, with only eleven states levying higher property taxes.

The median annual property tax in Washington is $2,631 for a home valued at the median price of $287,200. On average, counties in Washington impose a property tax rate of 0.92% of a property’s assessed fair market value each year.

Washington ranks among the states with the highest property tax rates in the nation, with only 11 states imposing higher rates.

With a median household income of $72,034 per year, the typical property tax paid by Washington residents accounts for approximately % of their annual income. This places Washington 11th out of 50 states for property taxes as a percentage of median income.

Property taxes in Washington vary depending on the county where the property is located. King County imposes the highest property taxes in the state, with an average annual tax of $3,572.00, which is 0.88% of the median home value. In contrast, Ferry County has the lowest property taxes, averaging $941.00 per year, or 0.64% of the median home value.

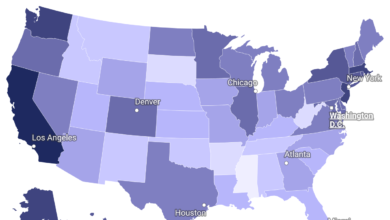

Franklin County Property Tax Rate 2024

The median property tax in Franklin County, Washington, is $1,687 annually for a home valued at the county’s median of $147,000. On average, the county charges property taxes at a rate of 1.15% of a property’s assessed fair market value.

Franklin County ranks among the highest in the United States for median property taxes, placing 641st out of 3,143 counties. Additionally, residents in Franklin County pay approximately 2.84% of their annual income on property taxes. In terms of property taxes as a percentage of median income, Franklin County is ranked 699th out of 3,143 counties.

King County Property Tax Rate 2024

The median property tax in King County, Washington, is $3,572 annually for a home with a median market value of $407,700. This means King County collects an average of 0.88% of a property’s assessed market value as property tax.

King County ranks among the highest in the United States for median property taxes, holding the 102nd position out of 3,143 counties nationwide.

On average, King County residents pay about 3.88% of their annual income toward property taxes. In terms of property taxes as a percentage of median income, the county is ranked 261st out of 3,143 counties.