A recent study by Third Way, using 2020 data from the U.S. Census Bureau, shows that many middle-class families in the U.S. are burdened with significant medical debt. Approximately 25% of those earning between $50,000 and $100,000 annually couldn’t fully pay their medical bills. Notably, Black and Hispanic middle-class individuals face the highest rates of medical debt.

In 2020, approximately 25% of middle-class American households struggled to cover their entire medical expenses. Notably, Black and Hispanic families experienced the most significant challenges when it came to medical debt, as per reports from the think tank Third Way and the U.S. Census Bureau.

During 2020, around 17 million middle-class people, constituting 23.5% of this group (individuals with household incomes between $50,000 and $100,000), experienced the burden of unpaid medical bills. Among them, 22% were from lower-income backgrounds, and 9% belonged to higher income brackets. This situation occurred despite middle-class families typically having better insurance coverage and lower-income families sometimes avoiding medical care due to its prohibitive costs.

The Third Way1 study reveals that middle-class individuals, regardless of factors such as education level, parental status, health insurance coverage, or location within the U.S., encounter the highest levels of medical debt. Within this middle-class group, individuals from Black and Hispanic backgrounds are disproportionately affected by medical debt compared to those of other racial and ethnic backgrounds.

Communities Most Affected

Black individuals grapple with a specific type of debt, in contrast 29% of their low-income counterparts and 21.5% of high-income earners. Simultaneously, 6 million, or 25.2%, of middle-class Hispanic individuals are burdened by unpaid medical bills, exceeding the 20.3% among low-income individuals and the 18.3% among high-income earners.

It’s noteworthy that middle-class individuals holding Bachelor’s degree experience a somewhat lower prevalence of medical debt at 16.5%, as opposed to those with some college education (25.5%), a high school diploma (26%), or no high school diploma (27.1%). Despite these variations, the overall trend indicates that middle-class Americans tend to carry heavier debt loads when compared to both low and high-income groups.

Age and Medical Debt Among Middle-Class Americans

When we consider age demographics, it becomes evident that middle-class Americans tend to bear a greater burden of medical debt compared to individuals at other income levels across various age groups. However, this trend shifts once we examine those aged 65 and older. In this particular age category, 14.4% of middle-class individuals carry medical debt, while a slightly higher 15.9% of people with lower incomes in the same age group are affected.

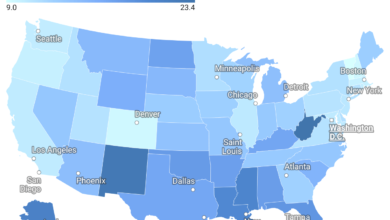

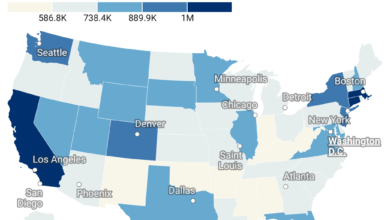

Geographic Distribution of Medical Debt Among Middle-Class Americans

A recent report by Third Way sheds light on the geographical disparities in medical debt among middle-class Americans. According to their findings, in the Southern region of the United States, a staggering 8 million people, equivalent to 28.1% of the middle-class population, grapple with medical debt. The Midwest follows closely behind, with 4 million individuals, or 24.6%, facing similar financial burdens.

Moving to the Northeast, 2 million middle-class individuals, accounting for 18.8% of the population in this category, find themselves affected by medical debt. Meanwhile, in the Western region, 9 million people, making up 17.8% of the middle-class demographic, share in this financial challenge.

It’s worth noting that Third Way’s report defines individuals as having medical debt if anyone in their household is burdened by it, providing a comprehensive perspective on the issue.

Separately, the Kaiser Family Foundation (KFF)2, a health policy research organization, estimates that a staggering 100 million Americans are grappling with some form of medical debt. However, it’s essential to acknowledge that when using the same Census data set, KFF highlights the uncertainty surrounding the impact of the pandemic and the ensuing financial crisis on medical debt.

In summary, regional disparities in medical debt among middle-class Americans are evident, with the South and Midwest experiencing the highest percentages. Moreover, the true extent of the pandemic’s influence on medical debt remains unclear, as indicated by KFF’s analysis of Census data.

Footnotes