Middle-Class Homeowners Face Growing Pressure from Rising Housing Costs

One in four new homeowners in the middle-income bracket — double the rate from ten years ago — are finding themselves in financially strained situations.

The proportion of middle-class Americans purchasing homes with high monthly payments has more than doubled over the past decade.

In 2022, nearly 30% of middle-class homeowners were paying more than 30% of their income toward their monthly mortgage, according to an analysis of Census Bureau data by Professpost.com. This is more than double the percentage from 2013. Experts are concerned that this trend leaves many households with less money for necessities like groceries and emergency expenses, making it harder for them to build financial security in the future.

The “cost-burdened” standard, which defines a household as spending more than 30% of its income on housing, is a commonly used indicator of affordability for both owning and renting a home. The Census Bureau compares housing costs to this benchmark, and the Department of Housing and Urban Development has relied on it for many years.

Domonic Purviance, a housing expert at the Atlanta Federal Reserve, noted, “It used to be that earning the median income was enough to afford the median-priced home. That’s no longer the case.”

When Haley and Ben Williams bought their home in Elkhart, Indiana, for $265,000 in December 2023, they were fully aware of the financial challenges ahead. With a mortgage rate of 8.125%, well above the national average of around 7% at the time, which was close to 20-year highs, they knew their monthly expenses would be significant. Their payments would include $176 toward the principal, with more than $2,000 going toward interest, taxes, and insurance.

Ben admitted, “We chose a house knowing it would be tough in the future,” but felt it was a necessary sacrifice. “We have a son and plan to grow our family,” he said. The alternative was to stay in a rental with a mold problem, which Haley described as a place they were “desperate” to leave, despite its $900 monthly rent.

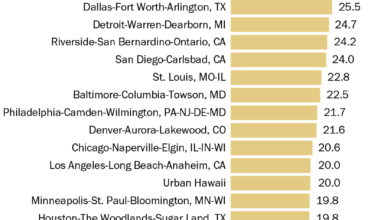

Homes within their budget, which they had hoped would peak at $250,000, sold quickly to cash buyers, the Williamses explained. Elkhart, a city of approximately 60,000 residents located about two hours east of Chicago, has a median home price of around $240,000 as of August 2024. In this area, a household earning the local average annual salary of $67,000 would spend about 22% of its monthly income on a median-priced home. While this ratio is still below the cost-burdened threshold of 30%, it has more than doubled in the past three years.

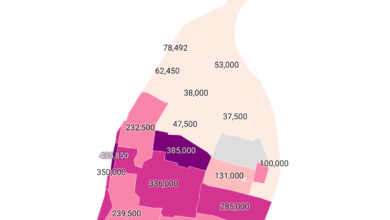

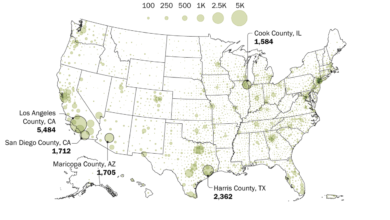

Elkhart is not an exception. Currently, in over 30% of U.S. counties tracked by the NBC News Home Buyer Index, average-income homebuyers faced with a median-priced home would find themselves financially strained if they were to purchase.

This situation has led many middle-class families to hold off on buying a home. In 2022, these households represented 49.7% of new homebuyers, a significant drop from 60.1% in 2010.