Most Popular Offshore Tax Havens for Rich Americans in 2025

How the Wealthy Protect Billions in Assets Across Borders

In an era of growing tax scrutiny and financial transparency, ultra-wealthy Americans are increasingly looking overseas to protect their assets and reduce their tax liabilities. While “offshore accounts” may sound shady, using them is completely legal when structured properly.

So, where exactly are America’s richest parking their wealth? Let’s explore the top offshore tax havens in 2025, backed by real data and expert insights.

📊 Why Offshore?

Wealthy individuals turn to offshore jurisdictions for several reasons:

Legal tax minimization

- Asset protection from lawsuits or political instability

- Estate planning and wealth transfer

- Greater privacy (though increasingly limited)

Note: Using an offshore structure is legal if disclosed to the IRS via FBAR or Form 8938.

🌐 Top Offshore Tax Havens in 2025

| Rank | Country | Personal Tax Rate | Corporate Tax Rate | FATCA Signatory | Bank Secrecy Score | Min. Wealth Required | FSI Rank |

|---|---|---|---|---|---|---|---|

| 1 | Cayman Islands | 0% | 0% | Yes | 70 | $250,000+ | #15 |

| 2 | Singapore | 0% (foreign) | 17% | Yes | 64 | $1M+ | #6 |

| 3 | Switzerland | ~20% | 8.5% | Yes | 57 | $500,000+ | #2 |

| 4 | British Virgin Islands | 0% | 0% | Yes | 74 | $200,000+ | #10 |

| 5 | Panama | 0% (foreign) | 25% | Yes | 79 | $150,000+ | #9 |

| 6 | Isle of Man | 0–20% | 0% | Yes | 63 | $300,000+ | #28 |

| 7 | Dubai (UAE) | 0% | 9% | No | 85 | $1M+ | #8 |

📈 Key Takeaways

- Cayman Islands and BVI remain top picks for zero tax and flexible structures.

- Singapore and Dubai are attracting tech entrepreneurs and crypto millionaires.

- Switzerland remains prestigious but less secretive post-FATCA.

🔧 Tools the Rich Use Offshore

- Offshore Trusts and Foundations

- International Business Corporations (IBCs)

- Private Banking Accounts

- Crypto Wallets in tax havens like UAE & Switzerland

📄 IRS Compliance & Legality

Offshore structures are legal when reported correctly:

- Report foreign accounts (FBAR)

- Disclose assets (Form 8938)

How Billionaires Use Offshore Havens

Example: The Walton Family (Walmart)

- Used foreign trusts and estate vehicles to minimize estate tax liabilities.

- While not illegal, the IRS has increased scrutiny on such structures in recent years.

Example: Silicon Valley Tech Executives

- Use Singapore or BVI holding companies to manage international subsidiaries and intellectual property.

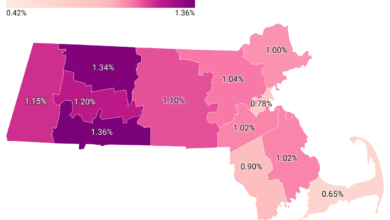

Bank Secrecy Score by Country

(Higher = more private)

Corporate vs Personal Tax Rates by Country

Conclusion

Offshore tax havens remain a powerful tool for the wealthy — not to hide money, but to legally protect and grow it. With increased regulations, the game has evolved — but for those who play it smart, the rewards are enormous.

📆 Sources

Note: Always consult a licensed tax attorney before engaging in offshore financial planning.