Over 60% of Home Listings Now Considered ‘Stale’ Due to Record-High Costs Dampening Demand

More homes are remaining unsold on the market for at least 30 days, as homebuying demand weakens due to high housing costs.

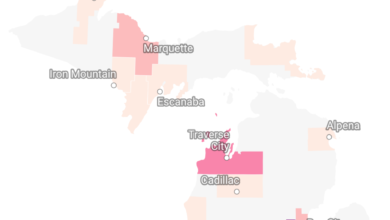

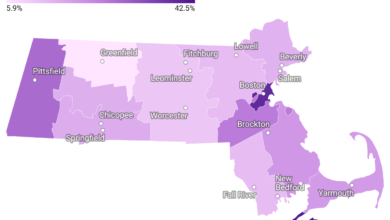

In May, over three out of five homes (61.9%) listed on the market had been available for at least 30 days without securing a contract. This is an increase from 60% the previous year and approximately 50% two years prior.

The number of homes remaining unsold for over a month has been growing each year since March. This trend began when new listings increased, but buyer interest stayed low due to rising mortgage rates since 2022. With more homes on the market and weak demand, less appealing properties are accumulating, leaving some without buyers.

According to an analysis of Redfin’s housing-market data, which dates back to 2012, the inventory data in this report includes homes that were on the market for at least 30 or 60 days without being contracted and were still actively listed on the last day of the month. The proportion of homes sitting for at least 30 or 60 days varies seasonally, usually peaking in the winter and hitting a low in the spring. This is why the charts in the report emphasize year-over-year changes.

Persistently high mortgage rates and record-high home prices have made it difficult for many prospective homebuyers to enter the market, reducing demand even during a period when the housing market usually becomes more active. The average 30-year fixed mortgage rate stands at 6.99%, more than twice as high as the lows seen during the pandemic and just below the two-decade peak of 7.8% reached in October 2023. The median monthly housing payment in the U.S. is now only about $30 short of its all-time high.