Top 10 U.S. States with the Highest Property Taxes for Homeowners in 2025

High property tax bills are the main reason these states rank as the most expensive places for homeowners.

Buying a home comes with significant upfront costs—between the down payment, closing fees, and ongoing mortgage payments, it’s a major financial commitment. Even once the mortgage is finally paid off, one cost never goes away: property taxes. For homeowners, this is a permanent expense that continues year after year.

When it comes to property taxes, location matters—a lot. Depending on where you live, you could be paying as little as $1,000 a year or well over $9,000. The states on this list have the highest median property tax bills in the country, making them the most expensive places for homeowners.

10) Washington – Median property tax: $4,361

Washington ranks as the tenth most expensive state for property taxes, largely due to its higher-than-average median home values.

However, homeowners can take some comfort in knowing that Washington’s capital gains tax doesn’t apply to real estate transactions. Plus, the state has no income tax, making it an appealing choice for many residents despite the high property costs.

9) Rhode Island – Median property tax: $4,854

Rhode Island may be the smallest state in the nation, but its property tax burden is anything but minor. With a median property tax bill exceeding $4,850, it ranks as the ninth most expensive state for homeowners.

Wealthier residents face an additional challenge: Rhode Island imposes a state estate tax with a much lower exemption than the federal threshold. In 2025, estates valued above $1,802,431 may be subject to state estate taxes, adding to the financial considerations of living—and dying—in the Ocean State.

8) California – Median property tax: $4,926

California is often associated with high taxes, and property taxes are part of that reputation. While the state’s average effective property tax rate is relatively low, the median property tax bill tops $4,900—largely due to elevated home values across many regions.

Still, California ranks only eighth on the list, thanks in part to more affordable areas that help offset the overall median, keeping the state from climbing even higher in property tax rankings.

7) Vermont – Median property tax: $4,956

Vermont provides a property tax credit of up to $8,000 for qualifying homeowners, which offers some financial relief. However, property taxes in the state are still relatively high, with median bills approaching $5,000, making homeownership in Vermont quite expensive.

When it comes to estate taxes, Vermont can also be costly for heirs. The state imposes an estate tax, but its exemption threshold of $5 million is significantly more generous compared to states like Rhode Island.

6) Illinois – Median property tax: $5,189

Homeowners in Illinois encounter some of the nation’s highest property tax burdens, with median tax bills surpassing $5,100. The state also imposes an estate tax, featuring a relatively low exemption limit of $4 million.

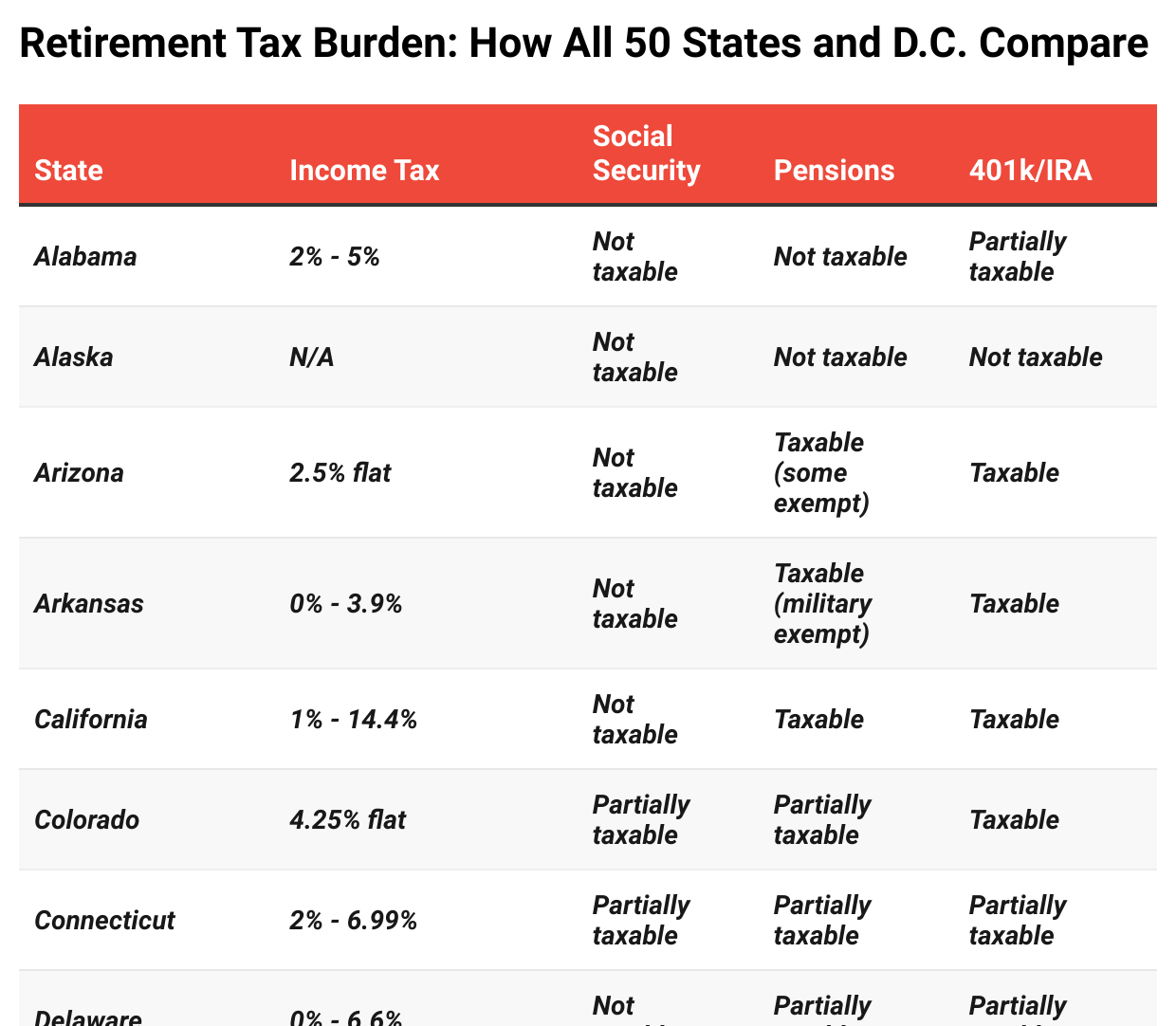

On the upside, not all taxes in the Prairie State are steep. Illinois is among just 13 states that do not tax retirement income, making it a potentially attractive option for retirees. Additionally, its flat income tax rate tends to benefit high earners.

5) Massachusetts – Median property tax: $5,813

Massachusetts ranks as the fifth most expensive state for homeowners, with median property tax bills topping $5,800. The state also imposes an estate tax on estates valued over $2 million, with rates ranging from 0.8% to 16%.

For high-income residents, tax burdens can be even heavier. According to other property taxes researchers, Massachusetts enforces a millionaire tax that adds an extra 4% on income above $1 million.

4) New York – Median property tax: $6,450

New York is well-known for its high taxes, particularly property taxes, where the median bill exceeds $6,400. The state also levies an estate tax on estates valued over $6.94 million, with rates ranging from 3.06% to 16%.

What makes New York’s estate tax especially daunting is its “cliff tax” provision: if an estate’s value exceeds 105% of the exemption threshold, the entire estate becomes subject to state estate taxes.

3) New Hampshire – Median property tax: $6,505

With a median property tax bill of $6,505, New Hampshire ranks third among the most expensive states for homeowners. Unlike many others on the list, the state’s high property taxes aren’t driven by high home values but by an average effective tax rate of 1.61%, making living in New Hampshire costly. Recently, property taxes on some mobile homes and condos unexpectedly tripled, adding to the burden.

On the plus side, New Hampshire has no income tax, which may make the overall tax picture more appealing for some homeowners. Additionally, the state recently eliminated its tax on interest and dividend income, offering potential savings for investors.

2) Connecticut – Median property tax: $6,575

Median property tax bills climb closer to $6,600 in Connecticut, and while the state offers a property tax credit to homeowners 65 and older, low-income limits mean many retirees aren’t eligible. Not all retirees are off the hook for state income taxes, either, since Connecticut is one of the states that tax Social Security benefits.

Wealthy residents of Connecticut could pass hefty tax burdens to their heirs, too. The Constitution State has an estate tax, but thankfully, it is much more generous than estate taxes in other states. So, most people won’t need to pay it.

1) New Jersey – Median property tax: $9,541

Despite property tax relief programs, New Jersey’s median property tax bill exceeds $9,500, making it the most expensive state for homeowners. This is driven not only by higher-than-average home values but also by the highest average effective property tax rate in the nation.

Although New Jersey doesn’t impose an estate tax, certain heirs—including siblings—may still face inheritance taxes, which range from 0% to 16%. On the positive side, transfers to parents, children, and some other close relatives are exempt from inheritance tax.