U.S. Cities Where Renters Must Earn $100K Salary Have Doubled Since 2020

A new report from Zillow highlights the deepening rental affordability crisis in the U.S., showing that renters in eight major cities now need six-figure incomes to afford housing comfortably—twice as many cities as just five years ago.

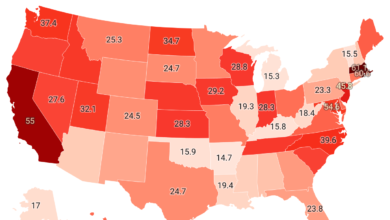

Since 2020, the annual income needed to afford a typical rental in the U.S. has climbed to over \$80,000—up from \$60,000—driven by a 28.7% rise in apartment rents and a 42.9% surge in single-family home rents. Meanwhile, the median household income has grown by just 22.5%, reaching around \$82,000. This disparity has deepened the affordability gap, making it harder for millions of renters to keep up.

“Housing costs have risen significantly since before the pandemic, with rent increasing much faster than wages,” said Orphe Divounguy, senior economist at Zillow. “This squeeze on income often leaves little room for other expenses, making it especially challenging for renters trying to save for a future home.”

Nationwide, renters earning the median income are now spending about 29.6% of their earnings on rent—just below the widely recognized 30% affordability threshold. However, in eight high-cost metro areas—San Jose, New York, Boston, San Diego, San Francisco, Los Angeles, Miami, and Riverside, California—renters must earn over $100,000 a year to stay under that threshold.In many U.S. cities, even median-income households are considered rent-burdened. Only San Jose (25%) and San Francisco (28%) remain technically affordable, as local incomes have kept better pace with rising rents.

Still, some cities offer relative affordability despite national trends. In places like Buffalo, NY; Oklahoma City, OK; and Louisville, KY, renters need annual incomes between $55,000 and $57,000 to afford typical rental units—spending no more than 23% of their earnings on housing.

Affordability challenges go beyond just monthly rent. In expensive metro areas such as New York and Boston, renters often face steep upfront costs, including broker fees and multiple advance payments. However, legislative efforts like New York City’s recently passed FARE Act, along with pending proposals in both New York and Massachusetts, aim to ease these hidden financial burdens.

As housing costs continue to rise, Zillow’s findings highlight the growing urgency for action from both renters and policymakers to address the shifting landscape of rental affordability in the U.S.