Which U.S. States Are Home to the Most Millionaires — and How Much They Pay in Taxes

Discover which U.S. states have the highest concentration of millionaires and explore their income, property, and sales taxes, revealing where wealth and taxes intersect.

Takeaways:

- High millionaire density does not always correspond with low taxes; some states retain wealth despite high tax rates.

- No-income-tax states are seeing growth in millionaire populations as individuals seek to preserve their wealth.

- Considering income, property, and sales taxes together provides a more complete view of a state’s financial environment for high-net-worth households.

- Wealthy residents prioritize a combination of economic opportunity, quality of life, and tax efficiency when choosing a state to live or invest in.

The distribution of wealth across the United States is far from uniform. Certain states are home to a surprisingly high percentage of millionaire households, while others attract fewer high-net-worth individuals. Understanding where millionaires live, and how much they pay in taxes, provides insight into the interplay between wealth, taxation, and lifestyle choices.

A state’s tax system—comprising income, property, and sales taxes—does not solely determine millionaire concentration, but it plays a significant role in influencing decisions about where to live, invest, and retire. Some states maintain a high concentration of millionaires despite relatively steep taxes, while others attract wealthy residents with no income tax policies or lower overall tax burdens. Examining these factors together helps paint a clearer picture of how tax policy and wealth distribution intersect.

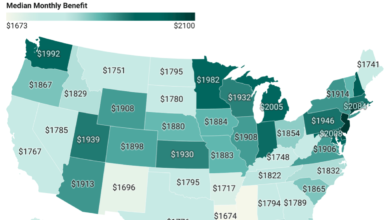

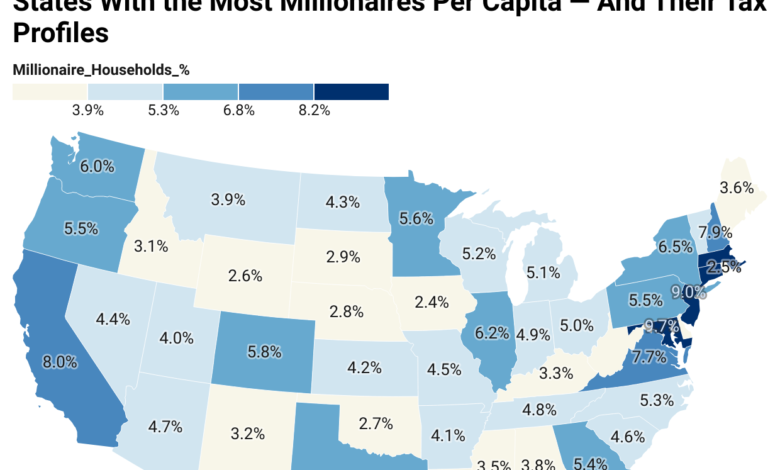

The map below presents each state’s percentage of millionaire households alongside key tax metrics: top state income tax rate, average property tax rate, and combined state and local sales tax rate. For instance, Maryland and Connecticut have some of the highest concentrations of millionaires, even though their income taxes are moderately high. Conversely, states like Florida, Texas, and Washington attract affluent residents with zero income tax, although property and sales taxes vary. This map helps illustrate the trade-offs wealthy households consider when choosing where to live.

Some states, including California, New York, and Massachusetts, remain magnets for millionaires due to strong economies, high-paying industries like technology, finance, and entertainment, and desirable lifestyle factors. High taxes in these states have not deterred residents because the benefits—career opportunities, cultural amenities, and robust professional networks—often outweigh the financial costs. Meanwhile, states with low or no income taxes, such as Florida, Texas, and Nevada, are increasingly popular among individuals looking to maximize their wealth while maintaining a comfortable standard of living.

Other taxes, such as property and sales taxes, also impact millionaire decisions. High property taxes can make even no-income-tax states less attractive for those owning expensive real estate, while high sales taxes increase the cost of consumption. As a result, wealthy individuals often weigh all tax types when planning relocation, retirement, or major investments.