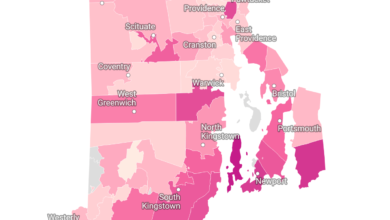

2025 Median Property Tax Rates by County in New Jersey

In New Jersey, the median annual property tax is $6,579 for a home with a median market value of $348,300. On average, counties across the state impose a property tax rate of 1.89% of a property’s assessed fair market value each year.

In New Jersey, the median annual income is $88,343, and the median yearly property tax paid by residents accounts for approximately a certain percentage of their income. Among all 50 states, New Jersey ranks 1st in terms of property taxes as a percentage of median income.

In New Jersey, the amount of property tax charged varies by county. Camden County has the highest property tax rate in the state, with homeowners paying an average of $5,587 per year, which is 2.05% of the median home value. In contrast, Cape May County has the lowest property tax rate, averaging $3,763 annually, or 1.12% of the median home value.

Hudson County Median Property Tax Rates in 2025

The median annual property tax in Hudson County, New Jersey, is $6,426 for a home with a median value of $383,900. On average, the county levies a property tax rate of 1.67% based on a property’s assessed fair market value.

Hudson County ranks among the highest in the United States for median property taxes, placing 14th out of 3,143 counties nationwide. Additionally, the average property tax paid by residents accounts for approximately 7.51% of their annual income, making Hudson County the 10th highest in the country in terms of property taxes relative to median income.