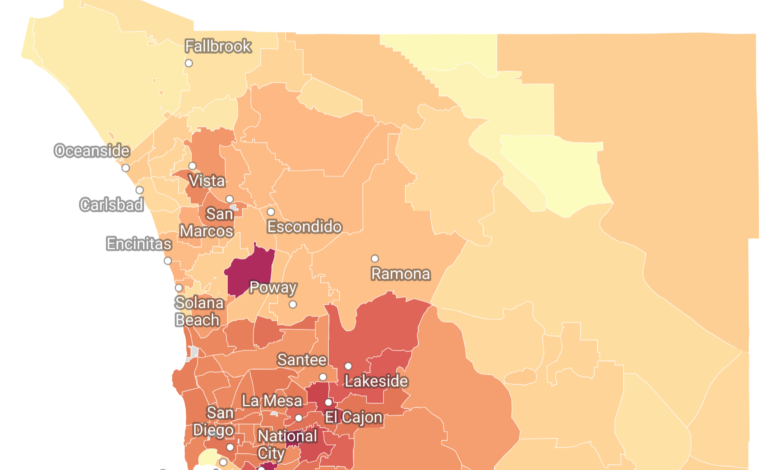

Median Property Tax Rates Across San Diego County / 2025

The median property tax rate in San Diego, CA is 1.22%, which exceeds both the national median of 0.99% and the California state median of 1.21%.

In San Diego County, the median home value is $454,653, resulting in an average annual property tax bill of $5,506—significantly higher than the national median of $2,690. Property taxes in the area are based on the assessed value of the home, which is typically lower than the market value due to various exemptions, such as those for primary residences and agricultural properties.

Highest Median Property Tax Rate in San Diego by Zip Code

The 91915 zip code, located near Chula Vista, CA, stands out in San Diego County with the highest median property tax rate of 1.71%. The area has a population of 24,659 residents and boasts a population density of 3,242 people per square mile. With 7,487 housing units, the median home value is $365,800. The land area covers 7.61 square miles, while 0.65 square miles is water. The neighborhood has 7,070 occupied housing units, and its median household income is $94,665.